Module 7: The "Don't Trust, Verify" Rule (DYOR)

Introduction: Why You Can't Take Anyone's Word in Crypto

"I saw on X.com that Elon Musk recommends this token." "My friend said this is the next Bitcoin." "A YouTuber with a million subscribers says to buy." Sound familiar? This is exactly how most beginners make investment decisions — trusting someone else's opinion without doing their own verification.

The result is predictable: according to research by the Cambridge Centre for Alternative Finance, 78% of retail crypto investors lose money in their first year. The main reason isn't market volatility — it's the lack of due diligence.

DYOR (Do Your Own Research) isn't just a popular phrase in the crypto community. It's a survival philosophy in an industry where:

- 90% of new projects turn out to be scams or die

- Influencers get paid for promotions (without disclosing it)

- Information is manipulated for pump and dump schemes

- Whitepapers can be completely fabricated

- There's no regulation or investor protection

The Golden Rule of Crypto Investing: If you can't explain why you're investing in a project (not "because everyone's buying" or "someone told me to"), you haven't done enough research. Don't invest in what you don't understand.

What is DYOR and Why It's Critically Important

Definition and Core Concept

DYOR (Do Your Own Research) — the principle of independently analyzing and verifying information before making investment decisions, without blindly trusting other people's opinions, even if they seem like experts or authorities.

What DYOR Includes:

- Technical analysis — studying the technology, code, and project architecture

- Fundamental analysis — tokenomics, team, partnerships, market

- Source verification — verifying claims, searching for facts

- Critical thinking — identifying manipulations and logical errors

- Comparative analysis — evaluation against competitors

- Risk assessment — understanding risks and their acceptability

Why You Can't Trust Others' Opinions

Reason 1: Conflict of Interest

Most crypto influencers make money from project advertising without disclosing it:

- YouTubers receive $5,000-50,000 per promo video

- X.com influencers — $1,000-10,000 per tweet

- Telegram channels — constant kickbacks from projects

- Many hold tokens and dump after promotion (pump and dump)

Reason 2: Incompetence

Popularity ≠ expertise. Many influential crypto bloggers:

- Have no technical education

- Don't read whitepapers and code

- Repeat information from other sources

- Draw incorrect conclusions due to misunderstanding

- Optimize content for algorithms, not quality

Reason 3: Echo Chambers and Groupthink

- Communities form bias in favor of "their" projects

- Critical opinions are suppressed or ignored

- An illusion of consensus is created

- FOMO is amplified by group euphoria

Reason 4: Manipulation and Coordinated Attacks

- Pump groups coordinate purchases and promotions

- Fake reviews and comments from bots

- Paid articles in crypto media

- Astroturfing — artificially creating "grassroots" support

Real Case Study: Bitconnect

In 2017-2018, numerous crypto influencers actively promoted Bitconnect, which promised 40% monthly returns. Dozens of YouTube channels with hundreds of thousands of subscribers made enthusiastic reviews. The project turned out to be a classic Ponzi scheme, and its collapse led to losses of $1+ billion. Influencers made millions from referral programs while their audience lost their savings. Lesson: a promoter's popularity doesn't guarantee a project's legitimacy.

DYOR Methodology: A Step-by-Step Research Framework

Stage 1: Initial Screening (5-10 minutes)

Quick verification of basic criteria — filtering out obvious junk.

Check 1: Website Legitimacy

- Professional design or template?

- Grammatical errors in the text?

- Do all links work?

- Is there contact information?

- When was the domain registered? (whois.com)

Check 2: Basic Documentation

- Is there a Whitepaper?

- Is there a Roadmap?

- Is tokenomics described?

- Is there Technical Documentation?

- If not — this is a red flag

Check 3: Team

- Public team or anonymous?

- Can you find LinkedIn profiles?

- Photos not from stock sites?

- Is there a track record in the industry?

Check 4: Social Media and Activity

- Is there activity on X.com/Telegram/Discord?

- Live community or bots?

- How long has the project existed?

- Regular updates or silence?

Check 5: Listings and Reputation

- Is it on CoinGecko/CoinMarketCap?

- Which exchanges is it traded on?

- What are the reviews on X.com/Reddit?

- Are there scam warnings?

Stage 1 Result: If the project fails >2 checks — discard it, don't waste your time.

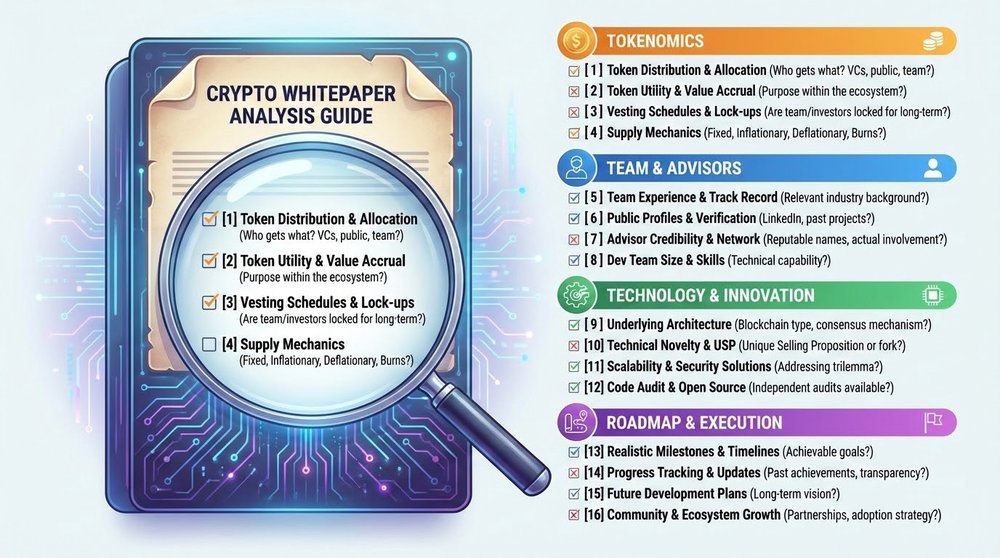

Stage 2: Whitepaper Analysis (30-60 minutes)

The whitepaper is the project's "constitution." All key information should be here.

What to Look for in a Whitepaper:

1. Problem and Solution

- Is the problem clearly described? Is it real or fabricated?

- Is the solution logical? Is blockchain really necessary?

- Is there product-market fit? Who will be the users?

- Uniqueness — what differentiates it from existing solutions?

2. Technical Details

- Architecture — is it clear how the system works?

- Consensus mechanism — PoW, PoS, DPoS, other?

- Scalability — TPS, latency, trilemma solution?

- Security — how is it protected from attacks?

- Interoperability — does it work with other blockchains?

3. Tokenomics

- Total supply — how many tokens in total?

- Distribution — who gets how much? (team, investors, community, reserve)

- Vesting — are team tokens locked? For how long?

- Utility — why is the token needed? Real utility or just speculation?

- Inflation/Deflation — emission, burn mechanisms

- Incentives — holder motivation, staking

4. Roadmap and Milestones

- Is the plan realistic? Or are they promising the impossible?

- Specific dates or vague "Q3 2024"?

- Past achievements — have they delivered on previous promises?

- Current stage — idea, MVP, working product?

5. Team and Partners

- Team experience — relevant background?

- Advisors — who are they and are they really involved?

- Investors — who invested? VC reputation?

- Partnerships — are claimed collaborations real?

Red Flags in Whitepapers:

- ❌ Copy-paste from other whitepapers (check with a plagiarism checker)

- ❌ Abundance of buzzwords without specifics ("AI-powered blockchain ML DeFi")

- ❌ Unrealistic promises ("100x guaranteed")

- ❌ Lack of technical details (only marketing)

- ❌ Poor structure, grammatical errors

- ❌ Tokenomics with >40% for the team

- ❌ No vesting for team/advisors

- ❌ Token utility is contrived

Stage 3: Technical Analysis (For Advanced Users)

If you can read code — huge advantage. If not — use proxy metrics.

For Those Who Can Program:

GitHub Analysis

- Is there a public repository?

- Are commits active? (last 7 days)

- How many contributors? (1-2 — bad, 10+ — good)

- Code quality (readability, documentation, tests)

- Issues and PRs — how does the team respond?

- Forked from where? (many projects are forks of existing ones)

Smart Contract Audit

- Is the contract verified on Etherscan?

- Has it been audited? (CertiK, PeckShield, OpenZeppelin)

- Read the audit report — what vulnerabilities were found?

- Were critical issues fixed?

- Check functions: mint, burn, pause — who has the rights?

On-chain Metrics

- Token distribution — top holders

- Liquidity — locked or not?

- Trading volume — real or wash trading?

- Address activity — growing user base?

- Check via TokenSniffer/Honeypot.is

For Non-Programmers:

Use Scanners

- TokenSniffer.com — automatic contract analysis

- RugDoc.io — rug pull risk check

- DexTools — token and liquidity analysis

- BubbleMaps — visualization of connections between holders

Read Audit Reports

- Even without understanding code, the audit report will show problems

- Critical/High severity issues — deal breaker

- Medium/Low — acceptable if fixed

- No audit — only for experimental amounts

Activity Metrics

- TVL (Total Value Locked) — for DeFi protocols

- DAU/MAU (Daily/Monthly Active Users)

- Transaction count — growing trend?

- Unique addresses — user base

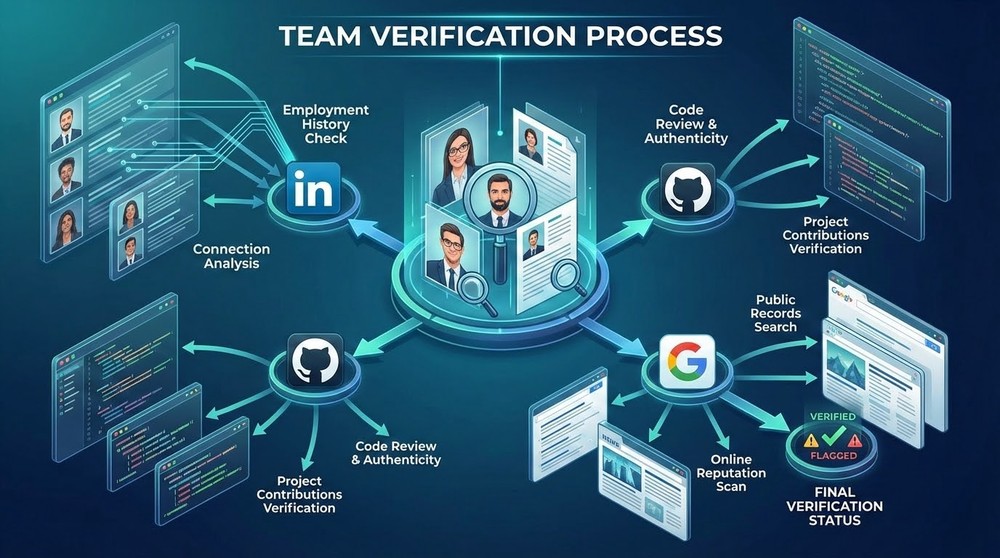

Stage 4: Team and Partner Verification (20-30 minutes)

The people behind the project matter more than the technology. A talented team can save a weak idea, but a weak team will ruin a brilliant one.

LinkedIn Profile Verification

- Find each team member on LinkedIn

- Do the photos match the website?

- Is the experience adequate for what's claimed?

- Are there endorsements from colleagues?

- Industry activity (posts, articles)?

Google Reverse Image Search

- Upload team member photos to Google Images

- Check if they're from stock photo sites

- Are they stolen from other people?

- Fake teams often use stock photos

X.COM/GitHub Activity

- Do team members have active X.com accounts?

- Post history — community participation before the project?

- Or was the account created a month ago specifically for the project?

- GitHub contributions — real developers?

Partnership Verification

- Don't trust logos on the website — easy to steal

- Look for official partnership announcements

- Check the partner's X.com — do they mention the project?

- Contact directly — confirm the partnership

- If the "partner" doesn't know about the collaboration — it's a scam

Background Check on Key Figures

- Did the CEO/CTO have previous projects?

- How did those projects end?

- Search "Name + scam", "Name + fraud" on Google

- Check Reddit, Bitcointalk — discussions

- Red flag: history of failed or scam projects

Stage 5: Community and Sentiment Analysis (15-20 minutes)

A healthy community is an indicator of legitimacy. A toxic or fake one is a red flag.

X.COM Analysis

- Followers/engagement ratio — 100K followers but 10 likes? Bots

- Discussion quality — substantive questions or spam "to the moon"?

- Criticism — how does the project respond? Constructively or with bans?

- Influencer mentions — who's talking about the project?

Telegram/Discord Check

- Community size — adequate for the project stage?

- Activity — live dialogues or dead chat?

- Admins — do they answer questions constructively?

- FUD handling — how do they react to criticism?

- Ban policy — banning for uncomfortable questions? Bad

Reddit/Bitcointalk Sentiment

- Search for project discussions

- What's the prevailing opinion?

- Is there substantiated criticism?

- Or only paid shilling?

Google Trends & Social Mentions

- Growing interest or decline?

- Does the hype match project development?

- Artificial boosting is visible through sharp spikes

Signs of a Healthy Community:

- ✅ Constructive technology discussions

- ✅ Critical questions are welcomed

- ✅ Team actively communicates with the community

- ✅ Long-term holders, not just flippers

- ✅ Organic growth, not spikes

Signs of a Toxic/Fake Community:

- ❌ Cult-like behavior, intolerance of criticism

- ❌ Only "wen moon" and price talk

- ❌ Banning for uncomfortable questions

- ❌ Bots and fake accounts

- ❌ Aggressive shilling everywhere

Stage 6: Competitive Analysis (30 minutes)

A project doesn't exist in a vacuum. Evaluation against competitors shows real chances.

Identifying Competitors

- Who solves the same problem?

- Direct competitors in the same niche

- Indirect — alternative approaches

Comparison Table

| Criterion | Project A (yours) | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Market Cap | $50M | $500M | $200M |

| TVL (for DeFi) | $10M | $2B | $100M |

| Active Users | 5K | 500K | 50K |

| Technology | New L2 | Proven L1 | Sidechain |

| Team | Strong | Legendary | Average |

| Partnerships | 2 major | 20+ Fortune 500 | 5 medium |

Evaluating Competitive Advantages

- First-mover advantage — who's first to market?

- Technology moat — is there unique technology?

- Network effect — who has more users?

- Ecosystem — dApps development, integrations

- Community — loyalty and size

- Funding — access to capital for development

Realistic Assessment of Chances

- If competitors are stronger on all parameters — why invest?

- If there are clear advantages — growth potential

- "Better technology" isn't enough — need a path to adoption

- Market share capture requires time and resources

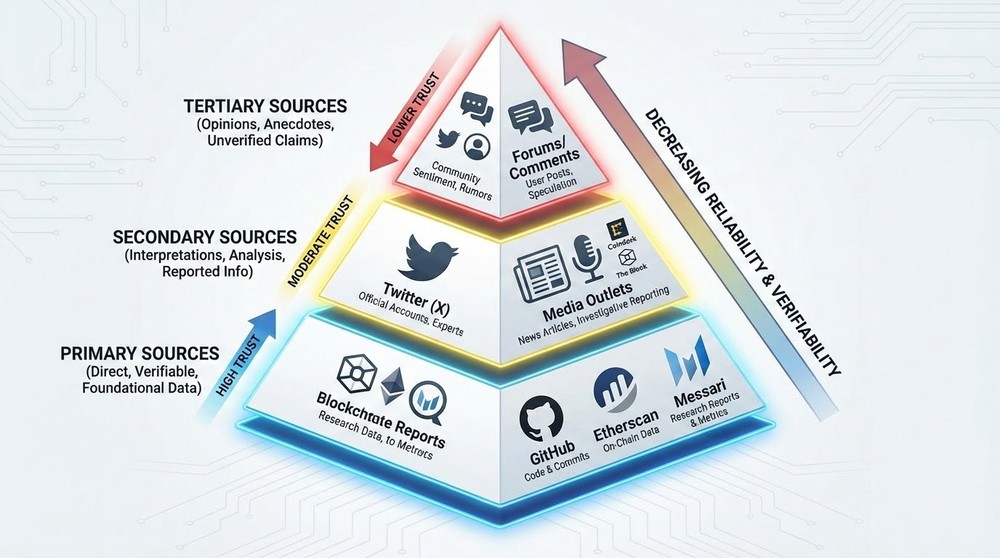

Information Sources: Where to Find the Truth

Tier 1: Primary Sources (Most Reliable)

Official Project Resources:

- Whitepaper — the primary source of the concept

- GitHub — real code and activity

- Official blog — announcements from the team

- Documentation — technical specification

- Audit reports — independent security assessment

Blockchain Data:

- Etherscan/BSCScan — objective on-chain metrics

- DeFiLlama — TVL and protocol data

- Dune Analytics — custom dashboards

- Nansen — professional analytics

Tier 2: Secondary Sources (Verifiable)

Research Platforms:

- Messari — deep project analytics

- TokenTerminal — protocol financial metrics

- CoinGecko/CoinMarketCap — basic data and ratings

- Glassnode — Bitcoin/Ethereum on-chain analytics

Quality Crypto Media:

- CoinDesk — industry news

- The Block — research and analytics

- Decrypt — educational content

- Bankless — DeFi focus

- Not Boring by Packy McCormick — strategic analysis

Analytical X.com Accounts:

- @VitalikButerin — insights from Ethereum's creator

- @hasufl — independent researcher

- @lawmaster — legal aspects

- @adamscochran — macro and strategy

- @cobie — trading and markets

Tier 3: Tertiary Sources (Use with Caution)

Use but Verify:

- Reddit r/CryptoCurrency — diversity of opinions, but lots of noise

- YouTube crypto channels — educational, but check for conflicts of interest

- Telegram/Discord groups — fast information, but lots of shilling

- X.com crypto community — sentiment, but echo chambers

⚠️ Avoid:

- ❌ Anonymous Telegram "signals" groups

- ❌ Paid "premium" groups without track record

- ❌ Crypto "gurus" with "how to get rich" courses

- ❌ Pump & dump coordination channels

- ❌ Sites with obviously paid reviews

Critical Thinking: How Not to Fall for Manipulation

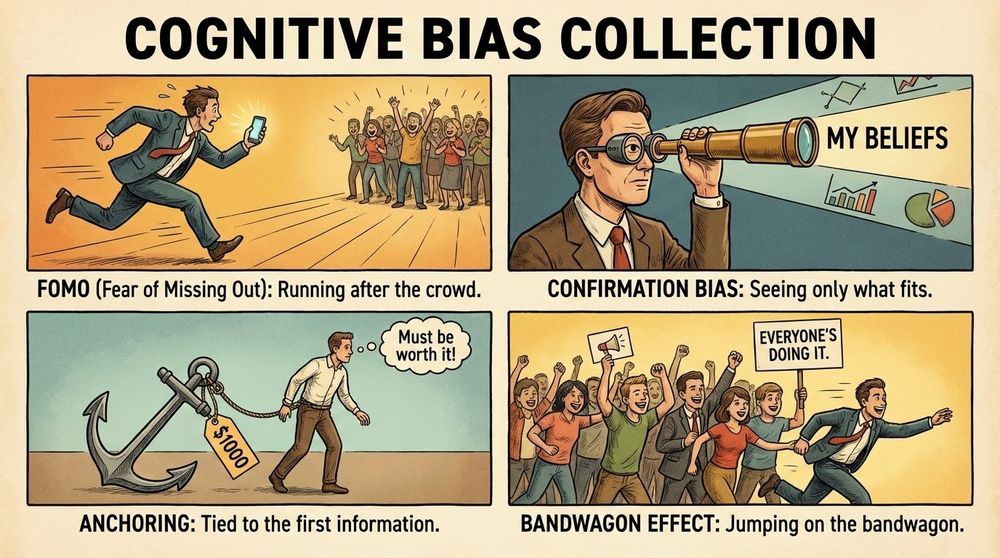

Common Cognitive Biases

1. Confirmation Bias

What it is: The tendency to search for, interpret, and remember information that confirms existing beliefs.

In crypto: You bought a token → you only look for positive news, ignoring red flags.

How to combat it:

- Actively search for arguments AGAINST the investment

- Play devil's advocate

- Read criticism of the project, not just praise

- Ask yourself: "What could go wrong?"

2. FOMO (Fear of Missing Out)

What it is: Fear of missing an opportunity when you see others making money.

In crypto: "The token went up 500%, everyone's buying, I'm late!"

How to combat it:

- 24-hour rule: no impulsive purchases

- Remember: there are thousands of opportunities, miss one — another will come

- Most "100x gems" turn out to be -90% losses

- If it's "urgent to buy" — it's manipulation

3. Anchoring Bias

What it is: Over-reliance on the first piece of information received.

In crypto: "The token was $100, now it's $10 — cheap!" (ignoring that fundamentals have worsened)

How to combat it:

- Evaluate current state, not past prices

- ATH doesn't mean the price will return

- Analyze current market cap, not token price

4. Bandwagon Effect

What it is: "Everyone's buying, so it must be right."

In crypto: Pump and dump schemes work precisely on this.

How to combat it:

- Crowds are often wrong (especially at tops)

- Popularity ≠ quality

- "Be greedy when others are fearful"

- Conduct your own analysis, ignoring hype

5. Sunk Cost Fallacy

What it is: "I've already invested $5,000, I can't exit at a loss."

In crypto: Holding a dying project, hoping for recovery.

How to combat it:

- Past investments shouldn't influence future decisions

- Ask: "Would I buy this now at the current price?"

- If the answer is "no" — sell

- Better to lose 50% than 100%

Recognizing Manipulative Techniques

Technique 1: Creating Artificial Scarcity

- "Only 1,000 whitelist spots"

- "Presale closes in 24 hours"

- "Limited edition NFT"

Reality: Legitimate projects give time for due diligence.

Technique 2: Social Proof Manipulation

- "10,000+ investors already joined"

- Fake testimonials and reviews

- Purchased likes and followers

Verification: Analyze engagement rate, look for real reviews.

Technique 3: Authority Exploitation

- "Backed by [famous VC]" (without proof)

- "Partnership with [major company]" (unconfirmed)

- Fake endorsements from influencers

Verification: Look for official announcements from the "partners."

Technique 4: Complexity as Smokescreen

- Overloading with technical jargon

- "AI-powered quantum-resistant zkSNARK protocol"

- Goal — to confuse so you don't ask questions

Countermeasure: If you can't explain it in simple terms — you don't understand it. Don't invest.

Control Questions Before Investing

Ask yourself these 10 questions. If you answered "no" or "I don't know" to 3+ — don't invest:

- Can I explain what the project does to a 12-year-old?

- Do I understand why the token is needed and where its value comes from?

- Do I know who's behind the project (real names and faces)?

- Have I read the whitepaper completely?

- Have I verified the team on LinkedIn and Google?

- Does the project have a working product or at least an MVP?

- Do I understand the risks and am I prepared to lose this money?

- Am I investing because of analysis or because of FOMO?

- Is this less than 5% of my portfolio? (for high-risk projects)

- Will I sleep peacefully if the token drops 50%?

Practical DYOR Example: Analyzing a Hypothetical Project

Let's break down the complete process using a fictional project "DecentraLend" (DeFi lending protocol) as an example.

Step 1: Initial Screening

✅ Website: Professional design, working links, no grammatical errors

✅ Documentation: 40-page Whitepaper, Technical Docs, Tokenomics paper

✅ Team: 8 people, all public, active LinkedIn profiles

✅ Social media: X.com 15K followers, Telegram 8K members, activity

✅ Listings: On CoinGecko, traded on Uniswap and Gate.io

Conclusion: Passes basic verification, continuing.

Step 2: Whitepaper Analysis

Problem: Existing lending protocols (Aave, Compound) have limited collateral options and high collateral requirements (150-200%).

Solution: DecentraLend uses AI risk assessment for personalized collateral ratios (from 110% for reliable borrowers).

Technology:

- Forked Compound V3 with modifications

- Chainlink oracle integration for prices

- Machine Learning model for credit scoring

- Multi-chain (Ethereum, Polygon, Arbitrum)

Tokenomics:

- Total supply: 100M DLT

- Team (15%, vested 4 years)

- Investors (20%, vested 2 years)

- Community (40%, farming rewards)

- Treasury (20%)

- Liquidity (5%)

Token Utility:

- Governance (voting on parameters)

- Staking to reduce borrowing rates

- Fee discount (10-30%)

Roadmap:

- Q1 2024: Mainnet launch ✅ (completed)

- Q2 2024: Polygon integration ✅

- Q3 2024: AI credit scoring beta (in progress)

- Q4 2024: Institutional partnerships

⚠️ Notes:

- AI credit scoring sounds ambitious — is there proof of concept?

- Tokenomics OK, but 35% for team+investors — quite a lot

- Token utility is average — governance isn't enough for value

Step 3: Technical Analysis

GitHub:

- ✅ Public repository

- ✅ 15 contributors, active commits

- ✅ Code is commented, has tests

- ⚠️ Compound fork — not unique technology

Audit:

- ✅ Conducted by PeckShield (March 2024)

- ✅ 0 critical, 2 high (fixed), 5 medium

- ⚠️ AI model wasn't audited (off-chain)

On-chain Metrics:

- TVL: $12M (growing)

- Unique users: 3,500

- Liquidity locked for 1 year ✅

- Top 10 holders: 28% supply ⚠️

TokenSniffer: 85/100 (good score)

Step 4: Team

CEO: John Smith

- ✅ LinkedIn: ex-Google engineer, 10 years experience

- ✅ GitHub: active contributor in DeFi

- ✅ X.com: 5K followers, participates in discussions

- ✅ Previous project: successful exit in 2021

CTO: Maria Garcia

- ✅ PhD Computer Science, Stanford

- ✅ Publications on ML and blockchain

- ✅ Contributor to Ethereum Foundation

Advisors:

- ⚠️ 2 well-known names, but no evidence of active participation

- Verification: no mentions of DecentraLend on their X.com

Step 5: Competitors

| Metric | DecentraLend | Aave | Compound |

|---|---|---|---|

| TVL | $12M | $6B | $3B |

| Market Cap | $50M | $1.2B | $800M |

| Uniqueness | AI credit scoring | Proven leader | Pioneer |

| Risk | High (new) | Low | Low |

Analysis: DecentraLend has potential thanks to AI innovation, but competes with giants. Upside is big, but risk is high too.

Final Assessment

Pros:

- ✅ Strong team with track record

- ✅ Innovative feature (AI scoring)

- ✅ Successful mainnet launch, growing TVL

- ✅ Audit passed

- ✅ Active community

Cons:

- ⚠️ Tough competition with Aave/Compound

- ⚠️ AI model not proven (beta)

- ⚠️ 35% tokens with team/investors

- ⚠️ Token utility not strong enough

- ⚠️ Small TVL for a DeFi protocol

Decision: Can consider a small position (1-3% of portfolio) as a high-risk/high-reward bet. Monitor AI functionality development. Not suitable as a core holding.

Conclusion: DYOR is a Skill That Requires Practice

DYOR isn't a one-time action before investing. It's a constant practice of critical thinking that develops with experience.

Your first research will take hours. Over time, you'll learn to quickly filter out junk and focus on quality projects. But never skip this process entirely.

Remember three principles:

1. Skepticism by default. Assume it's a scam until proven otherwise.

2. Multiple sources. One opinion isn't an opinion. Verify through 3+ independent sources.

3. Willingness to be wrong. Even the best DYOR doesn't guarantee success. Manage your risks.

Invest time in education. Every hour spent on DYOR saves thousands of dollars in potential losses.

In the next, final lesson of the course, we'll talk about anonymity and privacy in cryptocurrencies — how to protect your financial data and why privacy matters even if you have "nothing to hide."