Module 1: Hot vs Cold Wallets: Where to Store Millions and Where to Keep Pocket Change?

Introduction: Why Your Wallet Choice Is a Matter of Financial Security

Imagine this scenario: you put all your savings in one pocket of your jeans and head out for a walk through a crowded city. Sounds reckless? That's exactly what thousands of crypto newcomers do when they store all their funds on exchange accounts or in a single hot wallet.

In the cryptocurrency world, there's a fundamental rule: not your keys — not your coins. Understanding the difference between hot and cold wallets can be the deciding factor between preserving your capital and losing it entirely.

Key Security Principle: The higher the value of your assets, the colder your storage should be. The more frequently you need access to funds, the hotter your wallet can be.

What Are Hot Wallets and How Do They Work

A hot wallet is any crypto storage solution that's constantly connected to the internet. These include mobile apps, desktop programs, browser extensions, or web wallets.

Main Types of Hot Wallets

- Exchange Wallets — built into crypto exchanges (Binance, Coinbase, Bybit). Convenient for trading, but you don't control the private keys

- Mobile Wallets — smartphone applications (Trust Wallet, MetaMask Mobile, Exodus). Balance between convenience and security

- Desktop Wallets — computer programs (Electrum, Exodus Desktop). More control, but vulnerable to malware

- Browser Extensions — web browser plugins (MetaMask, Phantom, Rabby). Ideal for DeFi interactions

- Web Wallets — online services without software installation. Least secure option

Advantages of Hot Wallets

- Instant Access — execute transactions in seconds anytime

- User-Friendly — intuitive interface, suitable for beginners

- DeFi Integration — direct connection to decentralized applications

- Free to Use — most hot wallets don't require hardware purchases

- Cross-Platform — access from different devices through seed phrase recovery

Risks and Vulnerabilities of Hot Wallets

- Hacking Attacks — constant internet connection makes them targets for cybercriminals

- Malware — keyloggers, trojans, and clippers can steal your data

- Phishing — fake websites and apps trick users into giving wallet access

- Exchange Breaches — if an exchange is compromised, your funds there are at risk

- Human Error — accidentally sending funds to wrong addresses, connecting to malicious smart contracts

Cold Wallets: Fort Knox for Your Crypto Assets

A cold wallet is offline cryptocurrency storage, isolated from the internet. Private keys never touch the online environment, making them virtually immune to remote attacks.

Types of Cold Wallets

- Hardware Wallets — physical devices the size of a USB drive (Ledger Nano S/X, Trezor Model T/One, SafePal S1). The gold standard of security

- Paper Wallets — printed QR codes with keys. Outdated method requiring extreme caution

- Steel Wallets — metal plates with engraved seed phrases. Protection from fire, water, and physical damage

- Air-Gapped Computers — isolated PCs that have never connected to the internet. For the paranoid and large holdings

Advantages of Cold Storage

- Maximum Protection — hackers can't steal what they can't access online

- Malware Immunity — viruses are powerless without internet connection

- Long-Term Storage — ideal for savings and multi-year investments

- Private Key Control — complete independence from third parties

- Multi-Currency Support — modern devices support thousands of cryptocurrencies

Disadvantages of Cold Wallets

- Cost — quality hardware wallets range from $50 to $200

- Inconvenience — every transaction requires physically connecting the device

- Physical Loss Risk — lose the device and seed phrase, and your funds are gone forever

- Learning Curve — requires time to learn the interface and setup

- Purchase Vulnerability — never buy second-hand hardware wallets

Comparison Table: Hot vs Cold Wallets

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Security | Medium/Low | Maximum |

| Convenience | Very High | Medium |

| Transaction Speed | Instant | Requires Connection |

| Cost | Free | $50 to $200 |

| Best For | Small amounts, trading | Large sums, long-term holding |

| Hack Risk | High | Minimal |

| DeFi Interaction | Simple | Possible, but slower |

| Recovery | Via seed phrase | Via seed phrase + device |

Asset Distribution Strategy: The Multi-Layer Security Rule

Professional investors never put all their eggs in one basket. Apply a multi-layer security strategy by distributing crypto assets across different storage types based on goals and amounts.

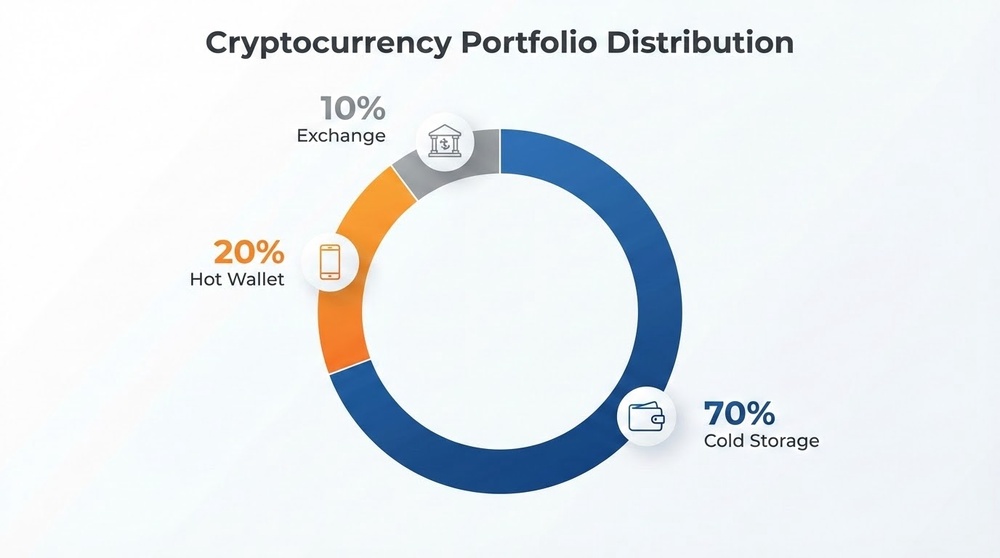

Recommended Distribution Structure

Universal Security Formula

- 70-80% of capital → cold storage (hardware wallet). Long-term investments you don't plan to touch for at least a year

- 15-20% of capital → hot non-custodial wallet (MetaMask, Trust Wallet). For DeFi, staking, NFTs

- 5-10% of capital → exchange. Only for active trading or quick swaps

- Small amounts for experiments → any convenient hot wallet

Examples for Different Capital Sizes

Capital under $1,000:

- Hot wallet (Trust Wallet, MetaMask) — entire amount

- Hardware wallet purchase not cost-effective

- Focus on seed phrase security and two-factor authentication

Capital $1,000-$10,000:

- Hardware wallet (Ledger/Trezor) — 60-70%

- Hot wallet — 20-30%

- Exchange — 10%

Capital over $10,000:

- Hardware wallet #1 — 50%

- Hardware wallet #2 (backup, different brand) — 30%

- Hot wallet — 15%

- Exchange — 5%

Practical Tips for Choosing and Using Wallets

For Hot Wallets

- Choose proven solutions — MetaMask, Trust Wallet, Exodus have millions of users and open-source code

- Verify download addresses — scammers create fake sites with malicious versions

- Enable biometrics — fingerprint or Face ID adds a layer of protection

- Never save your seed phrase in cloud storage, screenshots, or digital notes

- Use address whitelists — save verified addresses for regular transfers

- Check permissions — regularly revoke access from unused DeFi apps via Revoke.cash

For Cold Wallets

- Buy only from official manufacturers — no marketplaces or resellers

- Check packaging integrity — any signs of tampering = return the product

- Generate seed phrase on the device — never enter a pre-written one from the box

- Create a metal backup — paper seed phrases are vulnerable to fire and water

- Store in different locations — device and seed phrase should be kept separately

- Update firmware — manufacturers patch vulnerabilities with regular updates

- Use a passphrase — additional word to seed phrase for critical amounts

Top 3 Wallet Selection Mistakes

Mistake #1: Keeping All Funds on an Exchange

Exchanges are regularly hacked. Mt.Gox, QuadrigaCX, FTX — examples of major collapses where people lost billions. An exchange is not a bank; it's a trading platform.

Mistake #2: Using One Wallet for Everything

If your only wallet gets hacked or you lose the device, you lose all funds at once. Storage diversification is just as important as portfolio diversification.

Mistake #3: Buying Cheap No-Name Hardware Wallets

Counterfeits and devices with pre-installed malware exist. Saving $20-30 can result in losing all your assets. Trust only Ledger, Trezor, SafePal.

Golden Rule of Crypto Security: Spending $100-150 on a quality hardware wallet to protect $5,000-$10,000 isn't an expense — it's an investment in capital protection. The cost of one mistake is always higher than the cost of proper security.

Checklist: How to Start Storing Crypto Properly Right Now

- ☐ Assess your current capital — determine if you need a hardware wallet

- ☐ Withdraw main funds from exchanges — leave only trading amounts

- ☐ Install a verified hot wallet — Trust Wallet or MetaMask to start

- ☐ Properly save your seed phrase — write on paper, hide in a secure location

- ☐ For capital over $1,000, order a Ledger or Trezor — only from the official website

- ☐ Set up two-factor authentication — use Google Authenticator, not SMS

- ☐ Create a system — document where you store what (without specific addresses)

- ☐ Periodically review distribution — strengthen protection as capital grows

Conclusion: Security Starts with the Right Choice

Choosing between hot and cold wallets isn't an "either-or" question — it's about smart combination. Use hot wallets for daily operations and small amounts, and cold wallets for serious savings.

Remember: in the crypto world, you are your own bank. No one will recover lost funds, restore a forgotten password, or compensate for hack damages. Security responsibility lies solely with you.

Invest time in learning security basics now — it will save you from painful losses in the future. In the next lesson, we'll dive deep into seed phrases and why they're more important than the wallet itself.