Module 2: Bitcoin (BTC) — Digital Gold. History and Essence

Introduction: Why Is the Whole World Talking About Bitcoin?

If you've ever heard about cryptocurrencies, Bitcoin (BTC) was probably the first thing that came to mind. This is no coincidence: Bitcoin isn't just the first cryptocurrency in history, it's a revolution in understanding money that changed the financial world forever.

Imagine money that:

- No government controls — nobody can "print" more bitcoins

- Cannot be counterfeited — cryptography protects every transaction

- Can be sent anywhere in the world — without banks, intermediaries, or conversion fees

- Is limited in quantity — there will never be more than 21 million

Sounds like science fiction? But this is reality, and in this lesson, we'll break down how Bitcoin works, where it came from, and why it's called "digital gold."

💡 Fact: Bitcoin is the only asset in human history that is guaranteed to be limited in quantity while being divisible to 8 decimal places. One bitcoin can be divided into 100,000,000 satoshis — the smallest unit of BTC.

The History of Bitcoin: The Mysterious Satoshi Nakamoto

Bitcoin's story began during the height of the 2008 global financial crisis. Banks were collapsing, governments were printing trillions of dollars to "save the economy," and ordinary people were losing their savings. It was at this moment that Satoshi Nakamoto appeared.

The Whitepaper: The Document That Changed the World

On October 31, 2008, a person (or group of people) using the pseudonym Satoshi Nakamoto published a document titled "Bitcoin: A Peer-to-Peer Electronic Cash System."

This document, known as the "whitepaper," described a revolutionary concept:

- Decentralized payment system — without banks or central authorities

- Solution to the "double-spending" problem — making it impossible to spend the same money twice

- Transparency and security — through blockchain technology

- Limited supply — maximum of 21 million coins

Network Launch: January 3, 2009

Two months after publishing the whitepaper, on January 3, 2009, Satoshi Nakamoto mined the first Bitcoin block — the so-called "Genesis Block" (or block zero).

Satoshi embedded a message in this block — a headline from The Times newspaper:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks"

This message was not accidental. It permanently recorded in the blockchain the reason for Bitcoin's creation — as an alternative to a financial system that keeps failing ordinary people.

Satoshi's Disappearance

By 2010, Satoshi Nakamoto had handed over project management to other developers and gradually disappeared from public view. The last message from Satoshi is dated April 2011.

Satoshi Nakamoto's identity remains one of the greatest mysteries of our time:

- Is it a man, a woman, or a group of people?

- Is Satoshi still alive?

- Their wallets hold approximately 1 million BTC, which has never been spent

But the main point is — it doesn't matter. Bitcoin was designed to not depend on its creator. The network operates autonomously, supported by thousands of nodes worldwide.

What Is Bitcoin in Simple Terms?

Let's break down what Bitcoin is without complex technical jargon.

Bitcoin (BTC) is:

Digital Currency

Money that exists only in digital form. It has no physical form — no coins, no bills. But it's real and has value recognized by millions of people worldwide.

Decentralized Network

Bitcoin runs on a network of computers (nodes) scattered around the world. There's no central server that can be shut down. No company that can be closed. No CEO who can be arrested.

Protected by Cryptography

Every transaction is protected by extremely complex mathematical algorithms. Forging a transaction or "hacking" Bitcoin is virtually impossible — it would require computing power exceeding all the world's computers combined.

Limited in Quantity

The maximum number of bitcoins that will ever exist is 21,000,000 BTC. This is "hardcoded" and cannot be changed. Ever.

Why Is Bitcoin Called "Digital Gold"?

This isn't just a pretty metaphor. Bitcoin possesses all the key properties of gold that made it valuable for millennia, plus it has important advantages.

Comparison: Bitcoin vs Gold

| Characteristic | Gold | Bitcoin |

|---|---|---|

| Scarcity | Limited by nature, but exact quantity unknown | Strictly limited: 21 million BTC |

| Divisibility | Difficult to divide into small parts | Divisible to 8 decimal places (satoshis) |

| Portability | Heavy, difficult to transport | Can be stored on a USB drive or in memory |

| Verifiability | Requires expert verification | Instantly verified by the network |

| Storage | Requires physical vault and security | Just remember your seed phrase |

| Transfer | Physical transfer, requires logistics | Instant transfer anywhere in the world |

| Confiscation | Can be physically seized | Cannot be confiscated without keys |

| History | Thousands of years | Since 2009 |

🎯 Key Takeaway: Bitcoin took the best properties of gold as a store of value and improved them with technology. It also added something gold never had — the ability to transfer instantly across any distance.

Why Is Scarcity So Important?

Imagine if gold could be created out of thin air. It would instantly lose its value. It's precisely scarcity that makes an asset valuable.

This is exactly what happens with regular money (fiat):

- Central banks print money whenever they need to

- This leads to inflation — money loses purchasing power

- Your savings depreciate every year

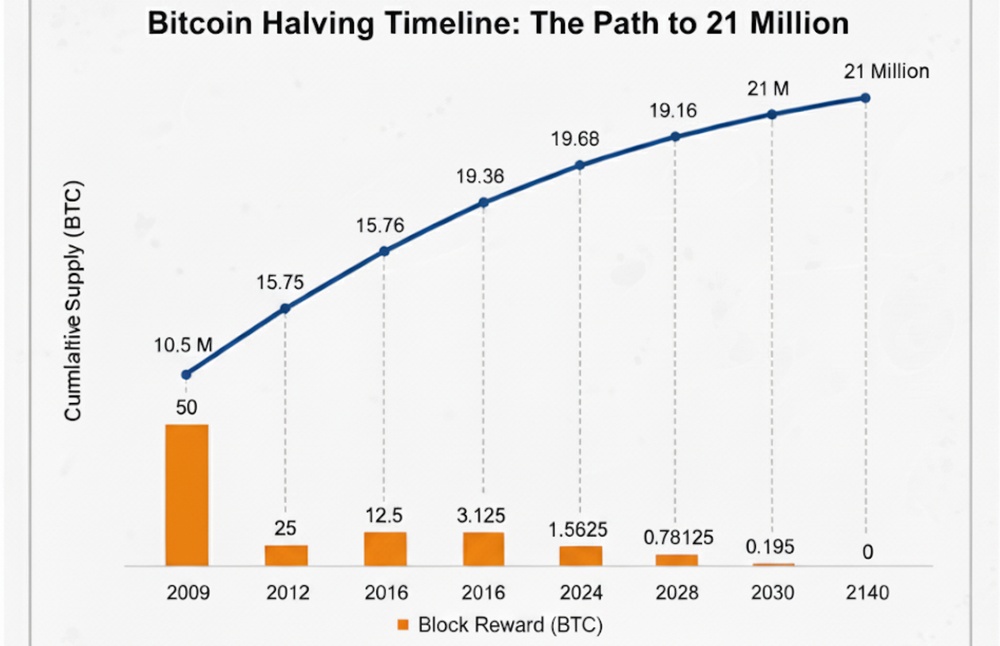

Bitcoin solves this problem mathematically. Bitcoin's code guarantees:

- New bitcoins are created only through mining

- The creation rate halves approximately every 4 years (halving)

- The last bitcoin will be mined around 2140

- After that — no new BTC ever

How Bitcoin Works: Core Principles

You don't need to be a programmer to understand Bitcoin. Just grasp a few key concepts.

Blockchain — The Foundation of Everything

If you completed the first lesson of our course, you already know what blockchain is. Here's a quick reminder:

Bitcoin's blockchain is a digital "ledger" that records all transactions since the network's inception. This ledger is:

- Public — anyone can view any transaction

- Distributed — stored on thousands of computers

- Immutable — records cannot be deleted or altered

Transactions: How Do You Send Bitcoin?

When you send bitcoins, here's what happens:

- You create a transaction — specifying the recipient's address and amount

- Sign it with your private key — this proves you own the bitcoins

- The transaction is broadcast to the network — all nodes see it

- Miners include it in a block — the transaction is recorded on the blockchain

- Confirmations — each new block makes the transaction increasingly "irreversible"

Addresses and Keys

Bitcoin uses a system of public and private keys:

🔓 Public Address

Like a bank account number. You can share it with anyone to receive payments. It looks something like: 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

🔐 Private Key

Like your bank password. Never share it with anyone. Whoever knows the private key owns the bitcoins at that address.

⚠️ Important: "Not your keys, not your coins" — if you don't control the private keys, you don't own the bitcoins. This is the golden rule of cryptocurrency.

Mining: Where Do New Bitcoins Come From?

New bitcoins are created through mining. Miners:

- Collect transactions into blocks

- Solve complex mathematical puzzles (Proof-of-Work)

- Receive a reward for finding a block — new bitcoins

This simultaneously creates new coins and secures the network. More on mining in Lesson 5 of our course.

Why Bitcoin Matters: Solving Real Problems

Bitcoin isn't just "internet money for geeks." It solves real problems that billions of people face.

Problem 1: Inflation and Currency Devaluation

When central banks print money, your savings lose value. Over the past decades, the dollar has lost more than 90% of its purchasing power.

Bitcoin solves this: Fixed supply means your bitcoins cannot be "diluted" by new coins. On the contrary — as demand grows and emission decreases, each bitcoin potentially becomes more valuable.

Problem 2: Financial Censorship

Banks and governments can freeze your account, reverse transactions, or block access to your money. This happens worldwide — from authoritarian regimes to democratic countries.

Bitcoin solves this: Nobody can block your transaction or confiscate your bitcoins if you control the private keys.

Problem 3: Financial Exclusion

According to the World Bank, approximately 1.7 billion adults don't have a bank account. They're excluded from the global economy.

Bitcoin solves this: To use Bitcoin, you only need a smartphone and internet access. No documents, bank approval, or credit history required.

Problem 4: Expensive International Transfers

Sending money to another country through a bank means days of waiting and fees up to 10% or more.

Bitcoin solves this: Transactions confirm in 10-60 minutes, regardless of amount or distance. Fees depend on network congestion, not the transfer amount.

Bitcoin as a Store of Value

More and more individuals and institutions view Bitcoin not as a payment method, but as a store of value — a way to preserve and grow wealth.

Who Buys Bitcoin?

- Individual investors — from everyday people to millionaires

- Public companies — adding BTC to treasury reserves

- Investment funds — offering clients cryptocurrency exposure

- Governments — some countries recognize BTC as legal tender

Arguments For Bitcoin as a Store of Value

Deflationary Nature

Unlike fiat currencies, the number of bitcoins is limited. As demand grows and emission decreases, this creates upward pressure on price.

Low Correlation with Traditional Assets

Bitcoin often behaves independently from stocks and bonds, making it a portfolio diversification tool.

Liquidity

Bitcoin trades 24/7, 365 days a year on hundreds of exchanges worldwide. You can buy or sell it at any moment.

Censorship Resistance

Your bitcoins cannot be confiscated or frozen if you store them properly.

Risks and Criticism of Bitcoin

It would be dishonest to only discuss advantages. Bitcoin is a high-risk asset, and you should understand its drawbacks.

Volatility

Bitcoin's price can change 10-20% in a day, 50-80% in a year. This means:

- Potential for significant profits

- But also potential for significant losses

- Not suitable for short-term savings

Regulatory Risks

Governments have varying attitudes toward cryptocurrencies. Some welcome them, others impose restrictions or bans. The regulatory environment continues to evolve.

Technical Complexity

Safely storing bitcoins requires understanding how wallets, private keys, and seed phrases work. Mistakes can lead to irreversible loss of funds.

Environmental Concerns

Bitcoin mining consumes significant amounts of electricity. This draws criticism from environmental activists. However, it's worth noting that:

- More miners are transitioning to renewable energy sources

- Bitcoin incentivizes energy infrastructure development in remote regions

- Energy consumption is also what secures the network

⚖️ Prudent Investor Principle: Never invest more than you can afford to lose. Bitcoin is a high-risk asset, and it's perfectly fine if it represents only a small portion of your portfolio.

Interesting Facts About Bitcoin

Finally — some facts that will help you better understand the scale of this phenomenon:

- First real purchase — in May 2010, programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC. This date is celebrated as "Bitcoin Pizza Day."

- Lost bitcoins — by various estimates, 3 to 4 million bitcoins are lost forever (lost keys, discarded hard drives). This makes the remaining coins even more scarce.

- Smallest denomination — 1 satoshi = 0.00000001 BTC. Named after Bitcoin's creator.

- A block is mined approximately every 10 minutes — regardless of the number of miners. Difficulty automatically adjusts.

- Bitcoin's code is open source — anyone can verify how it works. No secrets or backdoors.

Lesson Summary: Key Takeaways

Let's summarize what you learned in this lesson:

- Bitcoin (BTC) — the first and largest cryptocurrency, created in 2009

- Creator — Satoshi Nakamoto — pseudonym of an unknown person or group

- Maximum supply — 21 million BTC — guaranteed by code and cannot be changed

- "Digital gold" — Bitcoin has gold's properties (scarcity, durability, recognized value), but in digital form

- Decentralization — no central governing body, the network runs on thousands of independent nodes

- Security through cryptography — private keys protect your funds

- Risks include volatility, regulatory uncertainty, and technical complexity

🚀 Next Step: In the next lesson, we'll introduce Ethereum (ETH) — the second most important cryptocurrency, which took blockchain to an entirely new level with smart contracts.

Test Yourself

Answer these questions to make sure you've absorbed the material:

- When was Bitcoin created and by whom?

- Why is Bitcoin called "digital gold"?

- What is the maximum number of bitcoins that can exist?

- What does "Not your keys, not your coins" mean?

- Name three advantages and three risks of Bitcoin

If you can answer all these questions — excellent! You're ready to move forward. If not — reread the relevant sections of the lesson.