Module 7: Crypto Slang Dictionary: HODL, FOMO, FUD, Whale, Noob — The Ultimate Guide to Crypto Lingo

Welcome to a world where ordinary words take on entirely new meanings! If you've ever scrolled through crypto chats, forums, or Twitter (X) and felt like everyone was speaking an alien language — this lesson is for you. Cryptocurrency slang isn't just trendy jargon. It's an entire system of concepts that reflects market psychology, trader behavior, and community culture.

Mastering crypto slang gives you three critical advantages:

- Understanding market sentiment — when everyone's screaming "HODL!", you know panic is setting in

- Protection from manipulation — recognizing FUD helps you avoid falling for provocations

- Community integration — you speak the same language as experienced participants

💡 Key insight: Crypto slang isn't just jargon. Behind every term lies a specific market situation or psychological state of participants. By learning the slang, you're simultaneously studying the psychology of the crypto market.

HODL — A Legend Born from a Typo

Let's start with the most famous term in the cryptocurrency world. HODL (pronounced "hoddle") is a rallying cry to hold your cryptocurrency no matter what. Don't sell during crashes, don't panic, just hold.

The Origin Story of HODL

On December 13, 2013, a user named GameKyuubi posted on the BitcoinTalk forum with the title "I AM HODLING". Bitcoin had crashed that day from $716 to $438 — a drop of nearly 40%. The author, admitting he'd been drinking whiskey, wrote an emotional post about why he was NOT going to sell his bitcoins:

"I typed that HODLING thing twice because I knew it was wrong the first time. Still wrong. Whatever. Traders can spot the highs and lows. I can't. So I just hold."

The typo in the word HOLDING instantly became a meme. The community embraced it, and HODL transformed into a philosophy. Later, enthusiasts even created a backronym: Hold On for Dear Life.

When HODL Is Used

- During market crashes — as a reminder not to panic sell

- As a long-term strategy — buy and hold for years

- As a badge of belonging — "I'm a HODLer" signifies belief in the technology

The Psychology Behind the Term

HODL is an antidote to emotional decision-making. Research shows that most retail investors lose money precisely because of panic — selling at the bottom and buying at the peak. The HODL strategy eliminates this problem by removing emotions from the equation.

HODLer vs Trader

| Characteristic | HODLer | Trader |

|---|---|---|

| Investment horizon | Years | Minutes — months |

| Reaction to drops | Holds or buys more | May short sell |

| Required skills | Patience, belief in technology | Technical analysis, speed |

| Time in market | Minimal | Constant monitoring |

| Emotional load | Low (with discipline) | High |

FOMO — Fear Of Missing Out

FOMO (Fear Of Missing Out) is the fear of missing an opportunity. It's a powerful emotion that drives people to buy cryptocurrency at peak prices when everyone around them is bragging about profits.

How FOMO Works

Imagine this scenario: your colleague tells you they bought some coin a month ago, and it's up 500%. Your neighbor shows you a screenshot of their portfolio with massive gains. Social media is flooded with success stories. What do you feel?

- "I'm missing my chance to get rich!"

- "I need to buy now before it's too late!"

- "Everyone's making money except me!"

That's FOMO. And it's one of the main causes of financial losses in the crypto market.

Signs You're Under FOMO's Influence

- You're buying after a sharp price increase (green candles going up)

- You haven't researched the project, but everyone's talking about it

- You're investing more than you planned

- You feel anxious when you're not in the market

- You're making decisions quickly, without analysis

⚠️ Rule of experienced investors: "When your Uber driver starts giving crypto advice — it's time to sell." Mass FOMO usually signals a market top, not the beginning of a rally.

How to Combat FOMO

❌ Actions Driven by FOMO

- Emotional buying

- Chasing "moonshots"

- Ignoring risks

- Investing your last dollar

✅ Rational Approach

- Pre-planned strategy

- Research before buying

- Fixed budget

- Accepting missed opportunities

FUD — Fear, Uncertainty, and Doubt

FUD (Fear, Uncertainty, Doubt) is the intentional or unintentional spread of negative information that creates fear, uncertainty, and doubt among market participants.

Types of FUD

FUD comes in two types, and it's important to distinguish between them:

1. Intentional FUD (Manipulation)

- Fake news about cryptocurrency bans

- Rumors about major exchange hacks

- Fabricated celebrity statements

- Exaggerated project problems

2. Legitimate Negative News

- Actual regulatory restrictions

- Confirmed protocol vulnerabilities

- Real financial problems with projects

Who Spreads FUD and Why

| Source | Motivation | Example |

|---|---|---|

| Whales | Lower price to accumulate | "Leaked" project problems before buying |

| Competitors | Steal users | Criticizing competitor's technology |

| Short sellers | Profit from decline | Negative reports on popular coins |

| Traditional media | Attract audience | Sensational headlines about crypto "collapse" |

| Inexperienced participants | Panic, misunderstanding | Spreading rumors without verification |

How to Recognize FUD

Information Verification Checklist

- Source: Who's publishing? Do they have credibility?

- Evidence: Are facts provided or just emotions?

- Timing: Why did this news appear now?

- Cross-check: Do other independent sources confirm it?

- Cui bono: Who benefits from this information?

🛡️ FUD Protection: Develop the habit of verifying information from at least three independent sources. Official project channels, reputable publications, and blockchain data are your best friends.

Whale — Giant of the Crypto Seas

Whale is a market participant who owns a massive amount of cryptocurrency. The volume is so large that their actions can significantly impact the asset's price.

Who Qualifies as a Whale

There's no single definition, but typically Whales are:

- For Bitcoin: Wallets with more than 1,000 BTC

- For Ethereum: Wallets with more than 10,000 ETH

- For altcoins: Holders of more than 1% of total supply

Types of Whales

| Type | Description | Examples |

|---|---|---|

| Early adopters | Bought/mined cryptocurrency at the very beginning | Early Bitcoin miners |

| Institutional investors | Funds, companies, ETFs | MicroStrategy, Grayscale, BlackRock |

| Exchanges | Store user assets | Binance, Coinbase |

| Project founders | Received tokens at creation | Vitalik Buterin (Ethereum) |

| Crypto funds | Professional managers | a16z, Paradigm |

How Whales Influence the Market

Imagine a Whale wants to sell 10,000 BTC. If they do this in a single trade on the open market:

- The price would instantly crash (not enough buyers)

- They would get much less for their coins

- The entire market would see the sale and start panicking

That's why Whales use manipulation strategies:

Typical Whale Manipulations

- Wash trading: Creating the appearance of trading volume

- Pump and dump: Inflating price then dumping

- Spoofing: Fake large orders to create illusion of demand/supply

- Accumulation: Gradual buying through many small orders

- Distribution: Gradual selling under cover of good news

How to Track Whales

The blockchain is transparent, so large wallet movements can be tracked:

- Whale Alert — Twitter bot publishing large transactions

- Glassnode — coin movement analytics

- Santiment — wallet activity monitoring

- Etherscan/Blockchain.com — view transactions directly

Noob/Weak Hands — The Inexperienced Market Participant

Noob (or "weak hands") is an inexperienced, emotional market participant who makes typical mistakes and usually loses money. In some communities, they're also called "paper hands" or "retail bagholders."

Characteristic Traits of a Noob

- Buys at the top — enters the market when everyone's bragging about profits

- Sells at the bottom — panics during drops and locks in losses

- Believes in "insider tips" — buys based on anonymous advice

- Doesn't use stop-losses — hopes it will "bounce back"

- Takes loans for crypto — risks borrowed money

- Doesn't diversify — all-in on one "promising" coin

The Noob Life Cycle

📈 Bull Market Phase

The noob sees everyone making money. FOMO builds. They enter at the peak when it "definitely won't drop anymore."

📉 Bear Market Phase

The market reverses. The noob holds because "it's just a correction." Then panics and sells at the bottom.

🐹 Golden Rule: If you recognize yourself in the noob description — congratulations, awareness is the first step to solving the problem. Everyone was a noob once. What matters is learning from mistakes.

How to Stop Being a Noob

| Noob Mistake | Solution |

|---|---|

| Emotional buying | Create a plan BEFORE entering the market |

| Believing in "guaranteed profits" | Accept that losses are part of the game |

| No stop-losses | Determine exit point in advance |

| Investing all your money | Rule: only money you're prepared to lose |

| Chasing 100x gains | Focus on fundamental analysis |

Extended Crypto Slang Dictionary

Now that you've mastered the core terms, let's expand your vocabulary. You'll encounter these expressions constantly.

Price-Related Terms

| Term | Meaning | Usage Example |

|---|---|---|

| ATH (All-Time High) | Historical price maximum | "BTC just hit a new ATH!" |

| ATL (All-Time Low) | Historical price minimum | "Coin's at ATL, time to buy?" |

| Dump | Sharp price drop, sell-off | "Massive dump after the news" |

| Pump | Sharp price increase, inflation | "Someone's pumping this shitcoin" |

| Mooning / To the Moon | Strong growth, "flying to the moon" | "ETH is mooning! 🚀" |

| Bleeding | Declining in price | "Alts are bleeding following Bitcoin" |

| Crabbing (Flat) | Sideways movement, no growth or decline | "Market's been crabbing for a week" |

Trading Terms

| Term | Meaning | Usage Example |

|---|---|---|

| Long | Betting on price increase | "Opened a long on Bitcoin" |

| Short | Betting on price decrease | "Shorts got liquidated" |

| Liquidation | Forced position closure | "$500M in liquidations in one hour" |

| Leverage | Borrowed funds to increase position | "Trading with 20x leverage — suicide mission" |

| Stop-loss | Order for automatic sale on decline | "Got stopped out" |

| Take profit | Locking in gains | "Took profit at +30%" |

| DYOR (Do Your Own Research) | "Research it yourself," call for independent analysis | "NFA, DYOR" — not financial advice, do your own research |

Project-Related Terms

| Term | Meaning | Usage Example |

|---|---|---|

| Shitcoin | Worthless, garbage cryptocurrency | "Don't buy that shitcoin" |

| Scam | Fraud, deception | "Project turned out to be a scam" |

| Rug Pull | When creators take the money and disappear | "Classic rug pull — drained all liquidity" |

| Gem | Undervalued project with potential | "Found a gem at early stage" |

| Blue Chip | Reliable, established projects | "BTC and ETH are crypto blue chips" |

| Vaporware | Project with no real product, just promises | "Two years in — still vaporware" |

Community Slang

| Term | Meaning | Usage Example |

|---|---|---|

| Diamond Hands 💎🙌 | Hold no matter what, don't sell | "Only diamond hands will survive this dump" |

| Paper Hands 📄🙌 | Weak hands, selling at first drop | "Paper hands sold again" |

| Ape In | Enter without analysis, impulsively | "Aped into the project without DYOR" |

| WAGMI | We're All Gonna Make It | "Hold tight, WAGMI!" |

| NGMI | Not Gonna Make It | "Sold BTC at the bottom — NGMI" |

| GM / GN | Good Morning / Good Night — Crypto Twitter greeting | "GM, frens!" |

| Ser | "Sir" — ironic address | "Ser, this is a Wendy's" |

| Fren | Friend, like-minded person | "Hello frens" |

| Rekt | Wrecked, destroyed financially | "Shorts completely rekt" |

| No Coiner | Person without cryptocurrency, skeptic | "Typical no coiner hates what they don't understand" |

Market Psychology Through the Lens of Slang

Crypto slang is a mirror of market emotions. By understanding which terms dominate at any given moment, you can gauge crowd sentiment:

Market Stage Indicators

🐂 Bull Market

Dominant slang:

- "To the moon! 🚀"

- "WAGMI"

- "Diamond hands"

- "Buy the dip"

- "Supercycle"

Signal: Euphoria, mass FOMO

🐻 Bear Market

Dominant slang:

- "HODL!"

- "FUD"

- "Rekt"

- "Crypto is dead"

- "NGMI"

Signal: Fear, capitulation

📊 The Crowd Paradox: When everyone's screaming "To the moon!" — it might be time to consider selling. When everyone's convinced "crypto is dead" — it might be the best time to buy. Slang helps track these extremes.

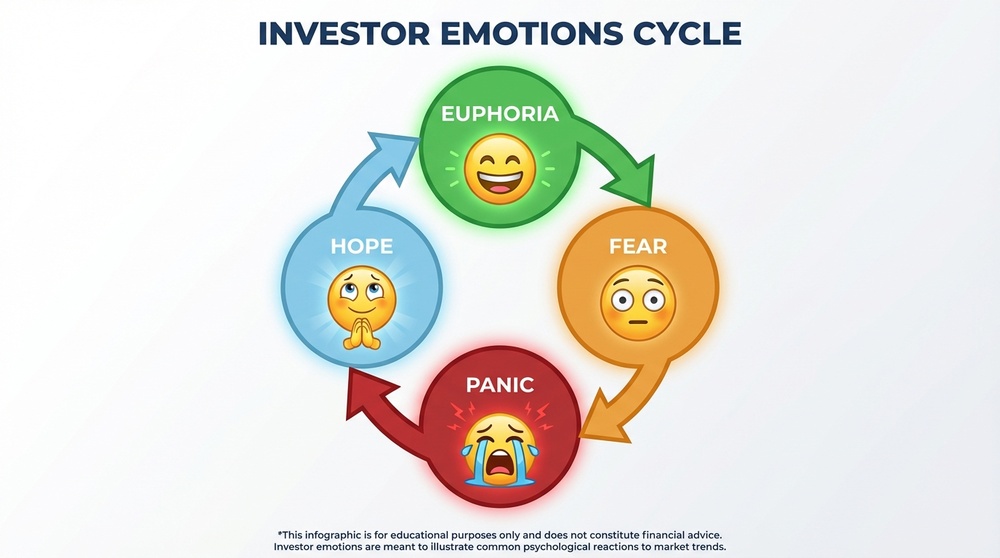

The Investor Emotion Cycle

The classic emotion cycle is perfectly described by crypto slang:

- Hope: "This is a gem! To the moon!"

- Optimism: "WAGMI! Diamond hands!"

- Euphoria: "Never selling! ATH!" (market top)

- Anxiety: "It's just a correction... HODL"

- Denial: "This is FUD, don't believe it!"

- Fear: "Maybe I should sell some?..."

- Panic: "It's all over! Selling!" (market bottom)

- Capitulation: "Rekt. Crypto is a scam"

- Depression: "Crypto is dead. NGMI."

- Disinterest: Market is "boring," little discussion

- Hope: The cycle begins again...

Practical Application of Knowledge

Now that you've mastered crypto slang, here's how to use this knowledge:

1. Social Signal Analysis

Monitor the tone of discussions on Twitter, Reddit, Telegram:

- Lots of "WAGMI" and rocket emojis — the market may be overheated

- Lots of "NGMI" and "crypto is dead" — the market may be oversold

- Calm technology discussions — healthy market state

2. Recognizing Manipulation

When you understand FUD mechanics and Whale actions, you can:

- Avoid panicking over artificial news

- Spot suspicious pump groups

- Critically evaluate "insider information"

3. Community Communication

By using proper slang, you:

- Get information faster (understand context)

- Are perceived as "one of us" (more trust)

- Communicate more effectively on forums and in chats

Homework

Practice reading Crypto Twitter or themed Telegram channels. Try to identify:

- What sentiment is dominating right now?

- Are there signs of FOMO or FUD?

- Can you spot Whale activity?

Keep notes — it's excellent practice for understanding market psychology.

Quick Reference Guide

Save this cheat sheet — it'll come in handy:

| Term | Brief Definition |

|---|---|

| HODL | Hold cryptocurrency, don't sell |

| FOMO | Fear of missing out |

| FUD | Fear, uncertainty, doubt (negativity) |

| Whale | Large cryptocurrency holder |

| Noob/Weak Hands | Inexperienced, emotional investor |

| ATH/ATL | All-time high/low |

| Pump/Dump | Sharp price increase/decrease |

| Diamond/Paper Hands | Resilience/Weakness during volatility |

| DYOR | Do Your Own Research |

| WAGMI/NGMI | We're All Gonna Make It / Not Gonna Make It |

| Rekt | Lost everything, wrecked |

| Rug Pull | Scam where creators run off with funds |

Conclusion

Congratulations! You've completed the final lesson of the "Crypto Kickstart: Master the Basics in 60 Minutes" course. You now possess the fundamentals of the cryptocurrency world:

- ✅ You understand how blockchain works

- ✅ You know the difference between Bitcoin, Ethereum, and altcoins

- ✅ You grasp mining, staking, and halving

- ✅ You speak the language of the crypto community

Crypto slang isn't just jargon. It's a tool for understanding market sentiment, protecting yourself from manipulation, and communicating effectively. Use this knowledge wisely.

🎓 Final advice: The crypto market constantly evolves, and slang evolves with it. New memes, terms, and expressions appear every month. Stay curious, keep learning, and remember — WAGMI! 🚀

Thank you for completing this course. Good luck on your crypto journey!