Module 4: Altcoins, Stablecoins, and Memecoins: What's the Difference?

You already know what Bitcoin and Ethereum are. But when you open any crypto exchange, your eyes glaze over: thousands of coins with different names, logos, and prices. How do you not drown in all this? How do you tell if you're looking at a serious project, a stable asset, or just another hype train that'll crash to zero in a month?

In this lesson, we'll break down the entire crypto world into clear categories. You'll learn to instantly identify the category of any coin and understand the risks and opportunities it carries. This is a fundamental skill for anyone who wants to do more than just "buy crypto" — but do it consciously.

💡 Key Principle: There are no "good" or "bad" categories of cryptocurrencies. There are tools with different purposes and different risk levels. Your job is to understand which tool to use when.

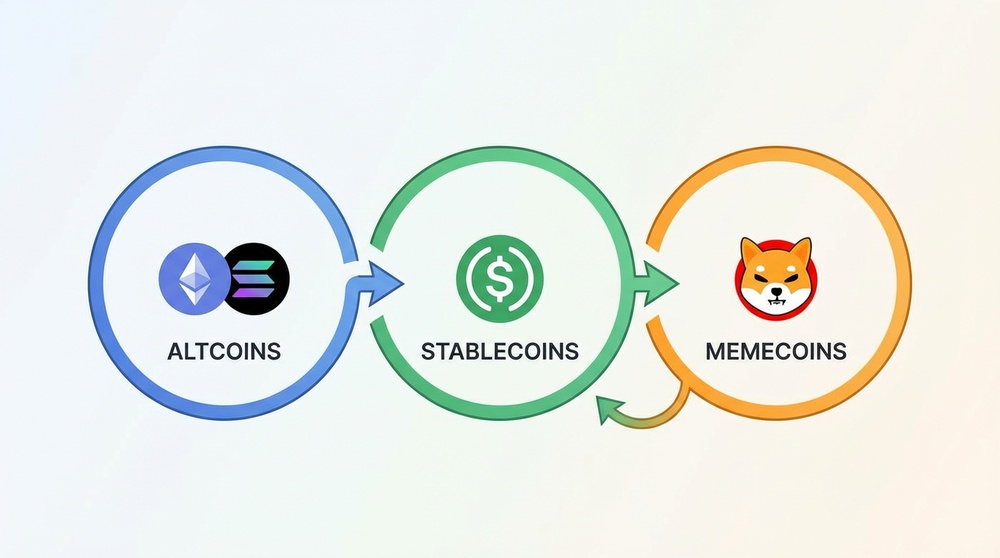

Part 1: Altcoins — The Bitcoin Alternatives

What Is an Altcoin?

Altcoin is any cryptocurrency that appeared after Bitcoin and offers an alternative approach to solving blockchain problems. The name comes from "alternative coin."

It's important to understand: altcoin is not a quality rating. It's simply a category. Ethereum is an altcoin. Solana is an altcoin. Even Dogecoin is technically an altcoin (though it's more often classified as a memecoin, but more on that later).

Why Did Altcoins Emerge?

Bitcoin is a brilliant invention, but it has limitations: slow transactions, high fees during network congestion, and the inability to create complex applications. Developers around the world started building their own blockchains to solve these problems or add new capabilities.

Altcoin Categories by Purpose

There are thousands of altcoins, but they can be divided into several main groups:

1. Platform Tokens (Layer-1)

These are cryptocurrencies of native blockchains that allow applications and other tokens to be built on top of them. Ethereum was the first, but now there are many such platforms.

- Ethereum (ETH) — the "world computer," the first smart contract platform

- Solana (SOL) — focused on speed and low fees

- Cardano (ADA) — a scientific approach to development

- Avalanche (AVAX) — focused on interoperability and speed

- Polkadot (DOT) — connecting different blockchains together

2. DeFi Tokens (Decentralized Finance)

Tokens of protocols that create financial services without banks: lending, swapping, insurance.

- Uniswap (UNI) — governance of the largest decentralized exchange

- Aave (AAVE) — lending protocol

- Chainlink (LINK) — transmitting real-world data to the blockchain

3. Scaling Tokens (Layer-2)

Solutions that work "on top" of main blockchains to make them faster and cheaper.

- Polygon (MATIC) — Ethereum scaling

- Arbitrum (ARB) — speeding up Ethereum transactions

- Optimism (OP) — a similar solution

4. Infrastructure Tokens

Projects that build infrastructure for the entire crypto economy.

- Filecoin (FIL) — decentralized data storage

- The Graph (GRT) — blockchain data indexing

- Render (RNDR) — distributed computing for graphics

5. Privacy Coins

Cryptocurrencies with enhanced transaction anonymity.

- Monero (XMR) — full privacy by default

- Zcash (ZEC) — optional privacy

How to Evaluate Altcoins?

Before investing in any altcoin, ask yourself these questions:

| Question | Why It Matters |

|---|---|

| What problem does the project solve? | If the problem is real and significant — the project has potential |

| Who's behind the project? | An experienced team with real names matters more than anonymous developers |

| Is there a working product? | Ideas are great, but working code is better |

| Who uses this product? | Real users and transactions speak louder than marketing |

| How are tokens distributed? | If 80% is held by the team — that's a red flag |

| What's the competition? | A unique solution is more valuable than another "Ethereum killer" |

⚠️ Important: Over 95% of altcoins won't survive the next market cycle. This isn't pessimism — it's statistics. Choose projects with real value, not just pretty promises.

Part 2: Stablecoins — Digital Dollars

What Is a Stablecoin?

Stablecoin is a cryptocurrency whose price is pegged to a stable asset, most often the US dollar. 1 stablecoin = 1 dollar. Always. Or almost always.

Why is this needed? Imagine: you sold Bitcoin at a profit and want to "sit out" a market downturn. But if you withdraw to a bank account — you'll pay fees, lose time, and then pay more fees when re-entering. Stablecoins solve this problem: you stay in the crypto ecosystem but are protected from volatility.

Stablecoins by the Numbers

- Total stablecoin market cap — over $130 billion

- Daily trading volume — often exceeds Bitcoin's trading volume

- Main use case — trading pairs on exchanges and transfers between platforms

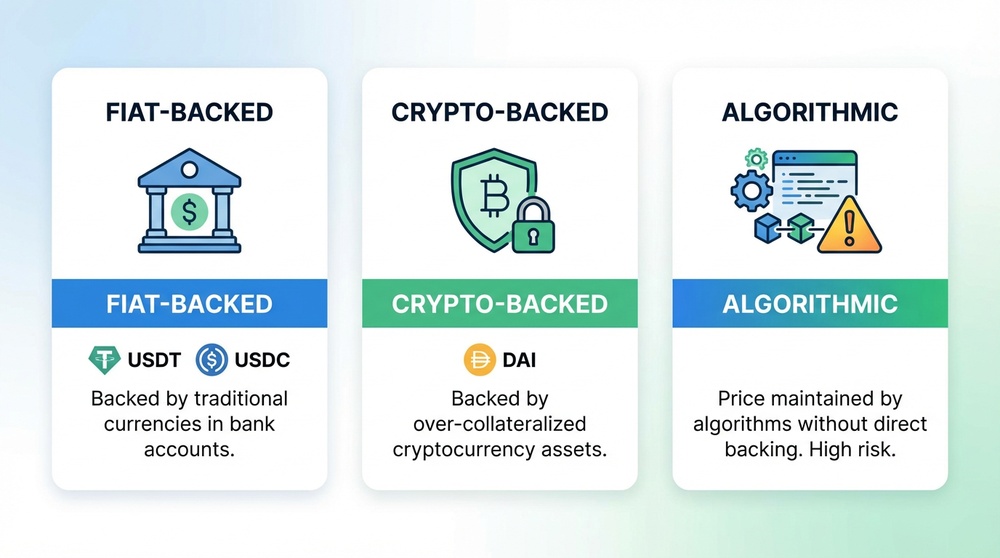

How Do Stablecoins Maintain Their Dollar Peg?

There are three main mechanisms for maintaining stability:

1. Fiat-Backed (Centralized)

For every token issued, a real dollar (or its equivalent in treasury bonds) sits in the company's bank account.

- USDT (Tether) — the largest stablecoin, over $80 billion

- USDC (Circle) — second largest, considered more transparent

- BUSD — Binance's stablecoin (now restricted)

Pros: simple and understandable model, high liquidity.

Cons: centralization, requires trust in the issuing company, risk of fund freezing.

2. Crypto-Backed (Decentralized)

The stablecoin is backed by other cryptocurrencies locked in a smart contract. Usually requires over-collateralization (e.g., 150% collateral of the amount).

- DAI (MakerDAO) — pioneer of decentralized stablecoins

- LUSD (Liquity) — backed only by Ethereum

- crvUSD (Curve) — stablecoin from a major DeFi protocol

Pros: decentralization, transparency, no one can freeze your funds.

Cons: more complex to use, lower capital efficiency.

3. Algorithmic Stablecoins

They attempt to maintain the peg through mathematical algorithms and market mechanisms, without real backing.

🚨 The UST/LUNA Collapse: In May 2022, the algorithmic stablecoin UST (Terra) lost its dollar peg and crashed to zero, wiping out over $40 billion in market cap in just a few days. It became one of the largest crashes in crypto history. Algorithmic stablecoins are a high-risk experiment.

Which Stablecoin Should You Choose?

| Stablecoin | Type | Reliability | Decentralization | Liquidity |

|---|---|---|---|---|

| USDT | Fiat-backed | Medium | Low | Maximum |

| USDC | Fiat-backed | High | Low | High |

| DAI | Crypto-backed | High | High | Medium |

| FRAX | Hybrid | Medium | Medium | Medium |

Practical Tip

Don't keep all your stablecoins in one place. Spread them across 2-3 different stablecoins (e.g., USDC + DAI). This protects you if one of them runs into problems.

Part 3: Memecoins — Joke Cryptocurrencies with Serious Money

What Is a Memecoin?

Memecoin is a cryptocurrency created based on an internet meme, joke, or viral trend. Memecoins usually have no serious technology or practical application. Their value is determined solely by hype, community, and virality.

Sounds completely absurd? Maybe. But some memecoins have market caps in the tens of billions of dollars and trade on the world's largest exchanges.

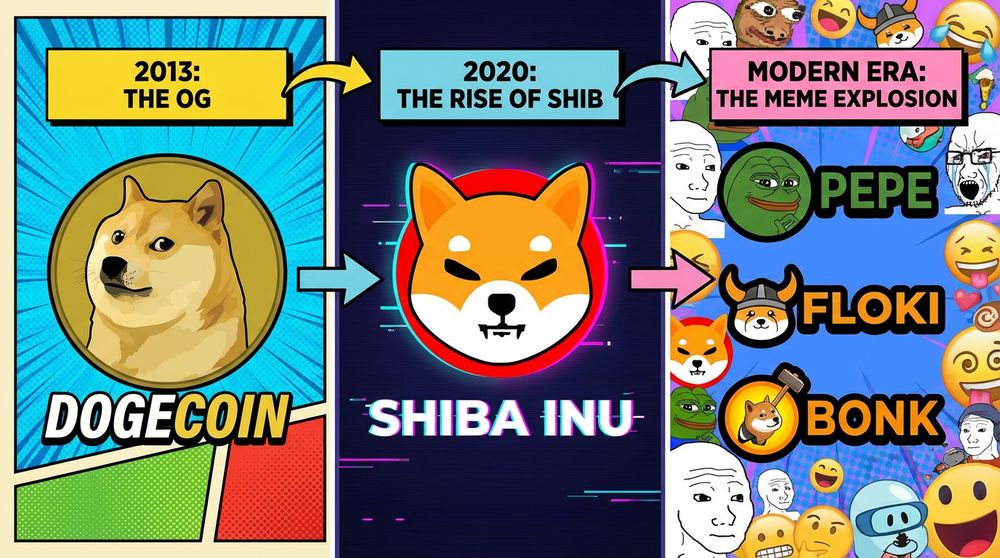

The History of Memecoins

Dogecoin (DOGE) — The Grandfather of All Memecoins

In 2013, programmers Billy Markus and Jackson Palmer created Dogecoin as a parody of the cryptocurrency hype. The logo featured the Shiba Inu dog from the popular "Doge" meme. The creators literally copied the code of another cryptocurrency (Litecoin), changed the name, and released it "for laughs."

No one expected what happened next:

- An active community formed around the coin

- Elon Musk started publicly supporting Dogecoin on social media

- During the bull market, the price rose by thousands of percent

- Market cap reached $80 billion

Shiba Inu (SHIB) — The "Dogecoin Killer"

Appeared in 2020 as an attempt to replicate Dogecoin's success. The creators went further: they added their own ecosystem with a decentralized exchange (ShibaSwap), NFTs, and even plans for their own blockchain.

The New Wave of Memecoins

After the success of DOGE and SHIB, thousands of imitators appeared:

- PEPE — based on the "Pepe the Frog" meme

- FLOKI — named after Elon Musk's dog

- BONK — memecoin of the Solana ecosystem

- WIF — "dog wif hat"

Why Do Memecoins Pump?

It's a paradox that's hard to explain with traditional economics. But there are several factors:

1. Low Barrier to Entry

Memecoins usually cost fractions of a cent. Psychologically, it's easier to buy "a million coins" than "0.001 Bitcoin," even if the amount is the same.

2. FOMO and Virality

Stories of "I invested $100 and became a millionaire" spread instantly. People fear missing "the next Dogecoin."

3. Influencer Impact

One tweet from a famous person can pump a memecoin's price by hundreds of percent in hours.

4. The Casino Effect

Many memecoin buyers are aware of the risk and treat it like gambling with a small stake.

📊 Statistics: Of the thousands of memecoins created each year, less than 1% retain any value after 12 months. Most go to zero completely.

Memecoin Risks

Rug Pull

Creators collect investor money and disappear. Especially common among new memecoins with no track record.

Pump & Dump

Coordinated artificial price inflation followed by a massive sell-off. Late buyers lose everything.

Zero Liquidity

When the hype fades, it may be impossible to sell tokens at any price — there are simply no buyers.

Hidden Code Functions

Some memecoins have functions that allow creators to block sales or infinitely mint new tokens.

The Golden Rule of Memecoins

Never invest more in memecoins than you're willing to lose completely. Treat it like a lottery ticket, not an investment. If you put in $50 — be prepared to see $0 in your account.

Part 4: Category Comparison Table

Now that you understand each category, let's put it all in one table:

| Parameter | Altcoins | Stablecoins | Memecoins |

|---|---|---|---|

| Purpose | Solving technological problems | Stability and payment convenience | Entertainment, hype, speculation |

| Technology | Usually original | Standard tokens + backing | Copies of existing coins |

| Volatility | High | Minimal (≈0%) | Extreme |

| Growth Potential | 10-1000x possible | None (pegged to dollar) | 1000x+ possible, but so is -99% |

| Loss Risk | Medium-high | Low | Very high |

| For Whom | Investors who believe in technology | Traders, for storage | Speculators ready for losses |

| Examples | ETH, SOL, ADA, LINK | USDT, USDC, DAI | DOGE, SHIB, PEPE |

Part 5: Practical Application of Knowledge

How Should a Beginner Allocate Their Portfolio?

This is not financial advice, but a general approach used by many crypto investors:

Conservative Approach:

- 60% — Bitcoin and Ethereum (time-tested)

- 25% — top altcoins (from the top 20 by market cap)

- 15% — stablecoins (for opportunities during dips)

- 0% — memecoins

Moderate Approach:

- 50% — Bitcoin and Ethereum

- 30% — altcoins with strong fundamentals

- 15% — stablecoins

- 5% — memecoins ("casino money")

Aggressive Approach (High Risk!):

- 30% — Bitcoin and Ethereum

- 50% — altcoins, including lesser-known ones

- 10% — stablecoins

- 10% — memecoins

🎯 Important to Understand: An aggressive approach can lead to significant profits as well as losing most of your capital. Choose a strategy that matches your risk tolerance and financial goals.

Checklist Before Buying Any Cryptocurrency

Before buying a coin from any category, go through this list:

- ☑️ I understand which category this coin belongs to

- ☑️ I've read the project's official website and documentation

- ☑️ I know who created the project (or consciously accept the anonymity risk)

- ☑️ I've checked the project on CoinGecko or CoinMarketCap

- ☑️ I understand how much I'm willing to lose in the worst case

- ☑️ This decision is based on research, not FOMO

- ☑️ I have an exit plan (at what price I'll sell)

Lesson Summary

Today you learned about three fundamental cryptocurrency categories:

🔷 Altcoins — these are technology projects with varying degrees of ambition and risk. Among them are future industry giants and one-day projects. The key to success is deep analysis before investing.

🔷 Stablecoins — these are digital dollars, a stability tool in a world of volatility. They're indispensable for trading and storing funds, but even they carry risks (depeg, freezing, issuer bankruptcy).

🔷 Memecoins — these are lottery cryptocurrencies. They can bring incredible profits or go to zero in a day. Treat them as entertainment with money you don't mind losing.

🧠 Key Takeaway: There's no "best" cryptocurrency category. Each serves its purpose. Your job as an investor is to understand these differences and use each tool for its intended purpose.

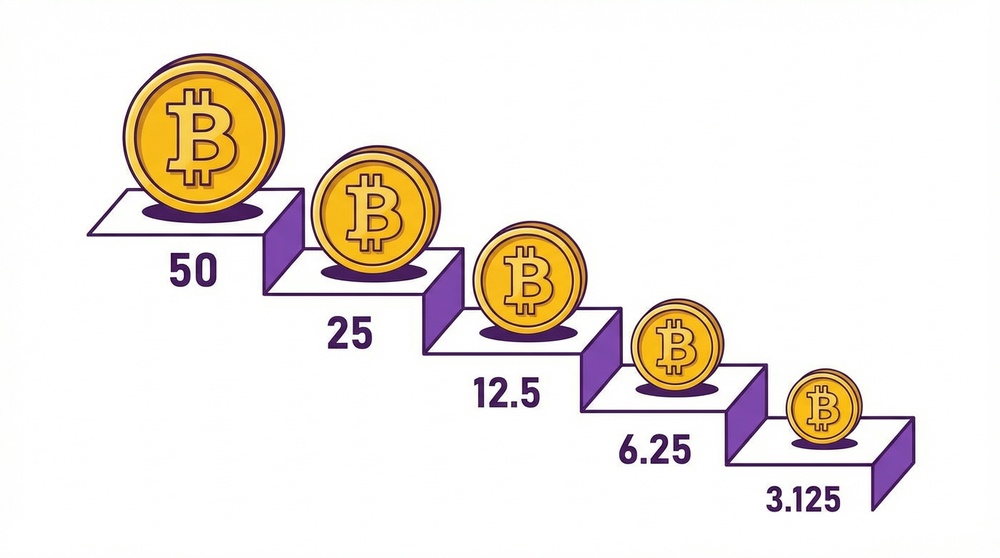

In the next lesson, we'll dive into the technical foundations of cryptocurrencies and break down Mining (PoW) and Staking (PoS) — the two main ways to create new coins and secure the blockchain.