Module 5: What is Mining (PoW) and Staking (PoS)? Where Do Crypto Coins Come From

💰 Money Out of Thin Air? How Cryptocurrencies Are Born

Have you ever wondered where bitcoins, ethers, and other crypto coins actually come from? Who "prints" them? After all, there's no central bank with a printing press in blockchain!

In this lesson, we'll break down the two main methods of creating new coins: mining (Proof of Work) and staking (Proof of Stake). You'll understand how they differ, their pros and cons, and most importantly — whether an average person can actually make money from them.

Important to understand: Mining and staking aren't just ways to earn money. They're fundamental mechanisms that ensure the security and operation of blockchains. Without them, crypto simply wouldn't exist.

⛏️ Mining (Proof of Work) — Digital Gold Rush

What is mining in simple terms?

Imagine that blockchain is a massive ledger where all transactions are recorded. Someone has to verify these entries and add new pages, right? That's exactly what miners do.

Mining (from the extraction of minerals) is a process where powerful computers solve complex mathematical puzzles to:

- Confirm transactions — verify that John actually sent 1 BTC to Mike

- Create a new block — package transactions into a block and add it to the blockchain

- Receive rewards — for their work, miners get new coins + transaction fees

Why is it called "mining"? Because the process resembles gold mining: the more resources (electricity, equipment) you invest, the more coins you can "mine."

How does it work technically?

Let's simplify. When you send bitcoin to a friend, that transaction goes into a "waiting pool." Miners take multiple such transactions and try to package them into a block.

But here's the catch: for a block to be accepted by the network, the miner needs to find a special number (called a nonce) that, when added to the block data, produces a hash with a certain number of zeros at the beginning.

Analogy for understanding

Imagine you need to guess a combination lock with 1000 combinations. You don't know the correct one — you have to try them all. That's what miners do — they try billions of combinations per second until they find the right one.

Whoever finds it first gets the reward and adds the block. Everyone else starts working on the next block.

Key characteristics of Proof of Work:

- Requires powerful equipment: Specialized devices (ASICs for Bitcoin, GPUs for other coins)

- Consumes a lot of electricity: The Bitcoin network consumes as much energy as a small country

- High security: To "hack" the blockchain, you'd need to control 51% of all network computing power (unrealistically expensive)

- Decentralization: Anyone can become a miner if they have the equipment

- Block reward: For example, in Bitcoin it's currently 6.25 BTC per block (after the 2026 halving)

Examples of PoW cryptocurrencies:

- Bitcoin (BTC) — the first and most famous

- Litecoin (LTC) — the "silver" of crypto

- Dogecoin (DOGE) — yes, the memecoin also runs on PoW

- Monero (XMR) — focused on privacy

- Ethereum Classic (ETC) — the old version of Ethereum

🏦 Staking (Proof of Stake) — Crypto Savings Account with Interest

What is staking in simple terms?

Now imagine a more eco-friendly and economical approach. Instead of spending electricity solving puzzles, you simply lock up your coins in the network. Like a bank deposit: put your money in, earn interest.

Staking (from stake — a share or bet) is a mechanism where network participants lock their coins as collateral to earn the right to confirm transactions and create new blocks.

The more coins you've locked (and the longer), the higher the chance the network will choose you to create the next block and you'll receive a reward.

How does it work?

In a Proof of Stake network, there's no race to solve puzzles. Instead:

- You transfer your coins to a special smart contract (they get locked)

- You become a validator — a participant who can confirm transactions

- The network randomly (but considering your stake) selects validators to create blocks

- If you do your job honestly — you receive rewards in the form of new coins + fees

- If you try to cheat — you lose part of your locked coins (this is called slashing)

How does PoS protect the network?

The logic is simple: if you have a lot of coins locked, it's not in your interest to attack the network. You'd lose your own money! It's like a bank owner trying to rob their own bank — they'd only hurt themselves.

To "hack" a PoS network, you'd need to own 51% of all coins (worth billions and economically pointless).

Key characteristics of Proof of Stake:

- Doesn't require powerful equipment: You can run a validator even on a home computer

- Energy efficiency: Consumes 99.95% less energy than PoW

- Lower barrier to entry: No need for millions in equipment (though you need the coins themselves)

- Passive income: You earn rewards just for holding coins (typically 5-20% APY)

- Eco-friendly: No carbon footprint from power plants

Examples of PoS cryptocurrencies:

- Ethereum (ETH) — transitioned from PoW to PoS in 2022 (The Merge)

- Cardano (ADA) — originally built on PoS

- Polkadot (DOT) — multichain on PoS

- Solana (SOL) — super-fast PoS blockchain

- Avalanche (AVAX) — another popular PoS project

⚖️ PoW vs PoS: Comparison Table

Let's visually compare these two consensus mechanisms:

| Characteristic | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| How blocks are created | Solving complex mathematical puzzles | Random validator selection based on stake |

| Equipment | ASIC miners, powerful GPUs | Regular computer or even smartphone |

| Energy consumption | Very high (like an entire country) | Minimal (like a home PC) |

| Entry barrier | High (need to buy expensive equipment) | Medium (need to have coins for staking) |

| Decentralization | Risk of centralization in mining pools | Risk of centralization among large holders |

| Security | Battle-tested for years (Bitcoin since 2009) | Relatively newer technology |

| Transaction speed | Slower (Bitcoin ~10 min per block) | Faster (Ethereum ~12 sec per block) |

| Eco-friendliness | ❌ Large carbon footprint | ✅ Near-zero carbon footprint |

| Participant rewards | New coins + transaction fees | New coins + transaction fees |

| Examples | Bitcoin, Litecoin, Dogecoin | Ethereum, Cardano, Solana |

Where Do New Coins Come From? Crypto Emission Explained

Now for the most interesting part: where do new coins in blockchain actually come from?

Emission through mining (PoW)

In Proof of Work networks, new coins are created as block rewards. When a miner finds the correct solution and creates a block, the protocol automatically "mints" new coins for them.

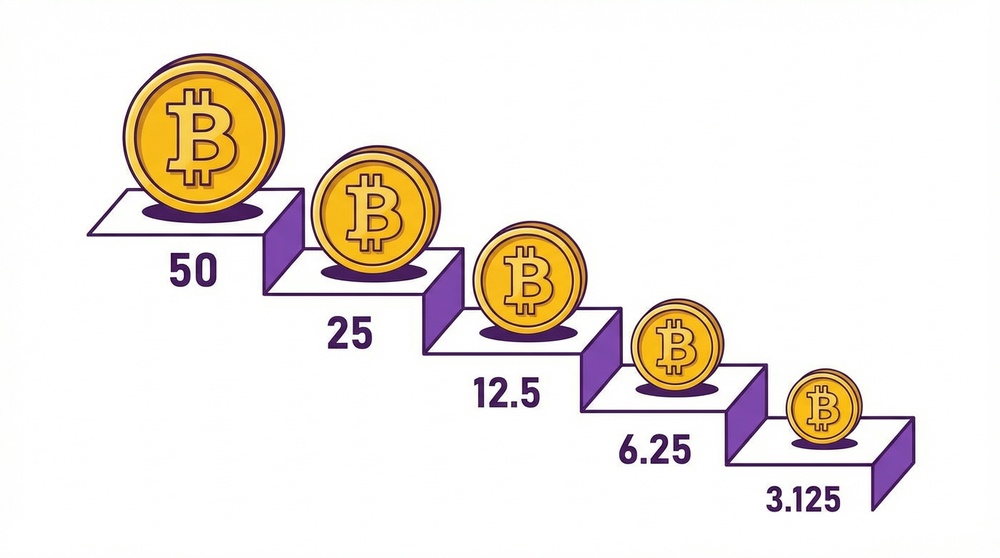

Bitcoin example:

- In the beginning (2009), the reward was 50 BTC per block

- Every 4 years, a halving occurs — the reward is cut in half

- Currently (after the 2026 halving), the reward is 6.25 BTC

- In 2028, it will be 3.125 BTC, and so on

- A maximum of 21 million bitcoins will ever be created (the last one around 2140)

This is called a deflationary model: The number of new coins decreases over time, and the total supply is limited. This makes Bitcoin "digital gold" — a scarce asset.

Emission through staking (PoS)

In Proof of Stake networks, the principle is similar but with nuances. New coins are created as rewards for validators who lock their coins and confirm transactions.

Ethereum example:

- Validators receive approximately 4-5% APY on staked ETH

- Emission is controlled by the protocol and can change

- After transitioning to PoS, Ethereum's emission dropped by 90%

- During high network activity, ETH can even become deflationary (more is burned than created)

Limited vs unlimited emission

🔒 Limited Emission

Example: Bitcoin (21M), Litecoin (84M)

Pro: Scarcity — the coin may appreciate over time

Con: When emission ends, miners will only receive fees (will that be enough incentive?)

♾️ Unlimited Emission

Example: Ethereum, Dogecoin

Pro: Constant incentive for validators, more stable inflation

Con: Inflation — the coin may depreciate over time (if demand doesn't grow)

💡 Can You Actually Make Money? A Realistic Look

Earning from mining

Short answer: difficult, but possible (under certain conditions).

What you need for profitable mining:

- Cheap electricity — this is critical! Some regions in Russia, Kazakhstan, and certain US states have low rates

- Modern equipment — old ASICs or GPUs become obsolete quickly

- Cold climate — spend less on cooling

- Technical knowledge — need to configure, monitor, and optimize

- Starting capital — from $3,000 for a basic rig to $50,000+ for serious operations

Reality: Large mining farms in China, USA, and Kazakhstan have long pushed out home miners. They have access to wholesale prices on equipment and electricity. But there are niche coins (like those on the RandomX algorithm) that can still be mined on CPUs.

Earning from staking

Short answer: more accessible, simpler, but lower returns.

What you need for staking:

- Buy coins — for Ethereum you need minimum 32 ETH (about $100,000), but you can use pools starting from 0.01 ETH

- Choose a platform — exchanges (Binance, Coinbase), wallets (Ledger, Trust Wallet), or your own validator

- Lock your coins — for a period (from weeks to years)

- Receive interest — typically 4-20% APY depending on the coin

Reality: Staking is passive income, like a bank deposit. But risks exist: the coin's price can drop, the platform can go bankrupt, the protocol can be hacked. Diversify!

⚠️ Important warning: Neither mining nor staking is "easy money." These are technological processes with risks. Before investing money, study the topic deeply, calculate profitability, and assess your risks.

🎯 Quick Lesson Summary

Let's reinforce the key points:

- Mining (PoW) — solving complex puzzles with powerful computers to create blocks. Requires equipment and electricity. Examples: Bitcoin, Litecoin.

- Staking (PoS) — locking coins to earn the right to confirm transactions. Energy-efficient, more accessible. Examples: Ethereum, Cardano.

- New coins are created through rewards to miners and validators. Emission can be limited (Bitcoin) or unlimited (Ethereum).

- Halving — periodic halving of rewards in PoW networks (relevant for Bitcoin).

- Earning is possible but requires investment, knowledge, and a realistic approach. Mining is harder, staking is more accessible.

What's next?

In the next lesson, we'll dive deeper into Bitcoin Halving: why everyone talks about it, how it affects the price, and when to expect the next one. It's one of the most important mechanisms in crypto!

Now you understand how cryptocurrencies are actually born and can explain it to your friends in simple terms. 🚀