Yield Farming is a powerful earning strategy in decentralized finance (DeFi) that allows cryptocurrency holders to earn rewards by providing their assets to various protocols. At its core, it's like putting money in a bank to earn interest, except in the blockchain world, returns can be tens of times higher. Yield farming became the catalyst for "DeFi Summer" and continues to attract millions of users with the opportunity to generate passive income from cryptocurrency.

📑 Table of Contents

🌾 What is Yield Farming

Yield Farming (literally "growing yield") is the practice of deploying cryptocurrency assets across various DeFi protocols to maximize returns. Farmers constantly move their funds between different protocols searching for the best conditions, similar to how a farmer chooses the most fertile fields for planting.

In Simple Terms: Imagine you have 100 apples. Instead of keeping them in a basket, you give them to your neighbor who uses them to make cider. In return, your neighbor gives you a portion of their profits daily + some new apples as a bonus. Yield Farming works on the same principle — you provide your crypto assets to protocols that use them for various financial operations, and they pay you rewards.

Key Yield Farming Concepts

💧 Liquidity

The cryptocurrency assets you deposit into a protocol. The more liquidity in a pool, the more efficiently the protocol operates and the lower the slippage during swaps.

🏊 Liquidity Pool

A smart contract that holds tokens from multiple users. These tokens are used to facilitate trading on decentralized exchanges or for lending purposes.

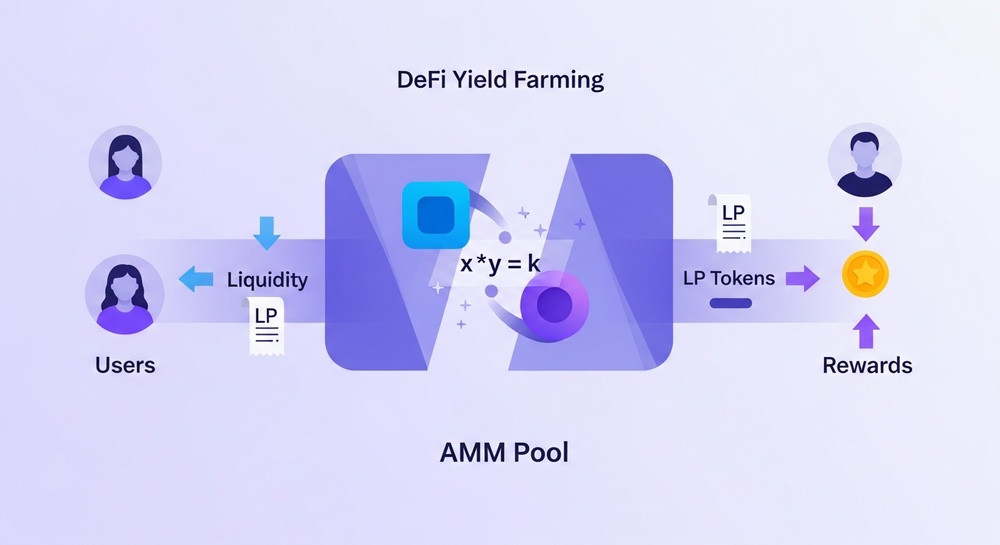

📜 LP Tokens (Liquidity Provider Tokens)

Special tokens you receive as proof of your contribution to a liquidity pool. They represent your share in the pool and can be used for additional farming.

📊 APY and APR

APR (Annual Percentage Rate) — annual interest rate without compounding. APY (Annual Percentage Yield) — yield including reinvestment (compound interest).

🔄 Auto-Compounding

Automatic reinvestment of earned rewards back into the pool to increase returns through compound interest. Many modern protocols do this automatically.

⚡ TVL (Total Value Locked)

The total value of all assets locked in a protocol. An important indicator of reliability and popularity — the higher the TVL, the more trust the platform has earned.

How Yield Farming Differs from Other Earning Methods

| Parameter | Yield Farming | Staking | Lending | Holding |

|---|---|---|---|---|

| Essence | Providing liquidity + token rewards | Locking tokens for network validation | Lending for interest | Holding assets |

| Potential Returns | 10-100%+ annually | 3-20% annually | 2-15% annually | Price appreciation only |

| Complexity | Medium-High | Low | Low | Minimal |

| Risks | Impermanent Loss, hacks, volatility | Slashing, volatility | Borrower default | Volatility |

| Active Management | Required | Minimal | Minimal | Not required |

⚙️ How Yield Farming Works

Understanding Yield Farming mechanics is critical for successful earnings. The process is based on the interaction of several key elements of the DeFi ecosystem.

Basic Mechanics

🔄 Yield Farming Cycle

Automated Market Makers (AMM)

Most Yield Farming protocols are built on AMM (Automated Market Maker) technology. Unlike traditional exchanges with order books, AMMs use mathematical formulas to determine asset prices.

📐 Constant Product Formula (x * y = k)

The most common AMM model uses the formula x * y = k, where:

- x — quantity of the first token in the pool

- y — quantity of the second token in the pool

- k — constant that must always remain unchanged

Example: A pool contains 10 ETH and 20,000 USDC. The constant k = 10 × 20,000 = 200,000. When buying 1 ETH from the pool, the USDC amount must increase so that k remains equal to 200,000. This automatically determines the exchange rate.

Types of Liquidity Pools

⚖️ Standard Pools (50/50)

Classic pools with equal value ratio of two tokens. Example: 50% ETH + 50% USDC. The most common type on Uniswap, SushiSwap.

Cons: Impermanent Loss during volatility

🎯 Weighted Pools

Pools with non-standard token ratios: 80/20, 70/30, etc. Allow reducing Impermanent Loss for one of the assets. Popular on Balancer.

Cons: Lower capital efficiency

🔄 StableSwap Pools

Optimized for swapping stablecoins and similar assets (USDC/USDT/DAI). Minimal slippage and virtually zero Impermanent Loss.

Cons: Only works with stable pairs

📊 Concentrated Liquidity

Advanced pools (Uniswap V3) where liquidity is concentrated within a specific price range. Maximum capital efficiency.

Cons: Requires active management

💰 Where Does the Profit Come From

One of the main questions from beginners: "Where do such high returns come from?" Unlike traditional finance, DeFi yields are generated from several sources.

📊 Income Sources in Yield Farming

- Trading Fees — a portion of fees from every swap in the pool

- Governance Tokens — rewards in the protocol's native tokens

- Interest Rates — interest from borrowers (in lending protocols)

- Incentive Programs — bonuses for attracting liquidity

- Compound Interest — reinvesting rewards (compounding)

Detailed Breakdown of Income Sources

1. Trading Fees (Swap Fees)

Every time someone makes a swap through a decentralized exchange, they pay a fee (usually 0.1-0.3% of the amount). This fee is distributed among all liquidity providers proportionally to their share in the pool.

2. Protocol Token Rewards

Protocols issue their own governance tokens and distribute them among liquidity providers. This attracts liquidity and gives users voting rights in protocol governance.

3. Lending Interest

In lending protocols (Aave, Compound), borrowers pay interest for using your funds. Part of this interest goes to liquidity providers. Rates are dynamic and depend on demand for borrowed funds.

4. Incentive Programs

New protocols often launch "liquidity mining" — distributing large volumes of tokens to early users to attract liquidity. This is what creates extremely high APYs at launch.

⚠️ Why High APY Doesn't Always Mean High Profit

Many beginners see 1000% APY and think they're guaranteed to 10x their capital. In practice:

- High APY is often paid in tokens with high inflation

- Reward token prices can fall faster than you earn them

- Impermanent Loss can "eat" all profits and even part of your deposit

- APY is calculated based on current conditions, which can change

🎯 Types and Strategies

Yield Farming includes many strategies of varying complexity and risk. Understanding each will help you choose the optimal approach for your goals.

Main Types of Yield Farming

1. Liquidity Mining

Classic farming — depositing tokens into DEX liquidity pools and receiving rewards in protocol tokens plus trading fees.

- Double income: fees + tokens

- High position liquidity

- Protocol governance rights

- Impermanent Loss

- Reward token volatility

- Gas fees

2. Yield Aggregating

Using aggregator platforms (Yearn Finance, Beefy) that automatically find the best strategies and reinvest rewards.

- Automatic compounding

- Gas savings

- Professional strategies

- Aggregator fee (10-20% of profits)

- Additional smart contract layer

- Less control

3. Lending/Borrowing Farming

Strategy using lending protocols: deposit collateral, take a loan, deposit borrowed funds, repeat the cycle to increase position (leverage).

- Increase position without selling assets

- Rewards for deposits AND borrowing

- Flexible position management

- Liquidation if collateral drops

- High complexity

- Variable interest rates

4. Stablecoin Farming

Farming in stablecoin pools (USDC/USDT/DAI). Minimal Impermanent Loss, but typically lower yields.

- Virtually zero IL

- Predictable returns

- Low volatility

- Stablecoin depeg

- Lower yields

- Regulatory risks

Advanced Strategies

| Strategy | Description | Yield | Risk | Complexity |

|---|---|---|---|---|

| Delta-Neutral | Hedging position to eliminate price risk | 15-30% | Low | High |

| Recursive Lending | Multiple cycles: deposit → borrow → deposit | 20-50% | High | Medium |

| Cross-chain Farming | Yield arbitrage between different networks | 25-100% | Medium | High |

| veToken Farming | Locking tokens for boosted rewards | 30-80% | Medium | Medium |

| Bribes Farming | Voting for pools in exchange for "bribes" from protocols | 20-60% | Low | Medium |

🏆 Popular Yield Farming Platforms

Choosing the right platform is a critical step. Let's examine the most reliable and popular protocols by category.

DEXs with Liquidity Pools

🦄 Uniswap

Networks: Ethereum, Arbitrum, Polygon, Base, Optimism

Features: Largest DEX, V3 concentrated liquidity, high security

TVL: Market leader

🍣 SushiSwap

Networks: Multichain (15+ networks)

Features: Cross-chain swaps, additional SUSHI rewards, product ecosystem

TVL: Top-10 DEX

🥞 PancakeSwap

Networks: BNB Chain, Ethereum, Arbitrum

Features: Low fees, wide pool selection, lotteries and NFTs

TVL: BNB Chain leader

⚖️ Balancer

Networks: Ethereum, Polygon, Arbitrum

Features: Customizable pools (up to 8 tokens), weighted pools, BAL rewards

TVL: Top-5 by liquidity

🔷 Curve Finance

Networks: Ethereum + L2

Features: Stablecoin specialization, minimal IL, veCRV mechanics

TVL: Stableswap leader

🌈 Velodrome/Aerodrome

Networks: Optimism / Base

Features: veToken model, high rewards, active community

TVL: Leaders in their networks

Lending Protocols

👻 Aave

Networks: Ethereum, Polygon, Arbitrum, Optimism, Avalanche

Largest lending protocol. Supports flash loans, credit delegation, stable and variable rates.

🏦 Compound

Networks: Ethereum, Base

DeFi lending pioneer. Compound III (Comet) — new generation with isolated markets.

🌊 Morpho

Networks: Ethereum

Optimizer on top of Aave and Compound. Improves rates through peer-to-peer matching.

📈 Radiant Capital

Networks: Arbitrum, BNB Chain

Cross-chain lending with high RDNT rewards for active users.

Yield Aggregators

🏭 Yearn Finance

OG yield aggregator. Automatic vaults with professional strategies. 20% performance fee.

🐮 Beefy Finance

Multichain aggregator (20+ networks). Huge vault selection. Auto-compounding every few minutes.

🌾 Harvest Finance

Simple and straightforward strategies. Focus on security. FARM token rewards.

🔮 Convex Finance

Curve specialization. Allows earning boosted CRV rewards without locking.

📝 Step-by-Step Guide to Getting Started

Follow this step-by-step guide to safely start earning with Yield Farming.

🎯 Preparation Phase

Before depositing funds, make sure you have:

- ✅ Cryptocurrency wallet (MetaMask, Rabby, Trust Wallet)

- ✅ Sufficient funds for gas in the required network

- ✅ Basic understanding of DeFi risks

- ✅ An amount you're prepared to lose

Step 1: Choose Network and Set Up Wallet

💡 Money-Saving Tip

Start with L2 networks (Arbitrum, Optimism, Base) or alternative L1s (Polygon, BNB Chain). Gas fees there are 10-100x lower than Ethereum Mainnet.

Step 2: Choose Platform and Pool

🔍 What to Look for When Choosing a Pool:

- TVL (Total Value Locked) — the higher, the more reliable. Minimum $1M for safety

- APY vs APR — understand the difference. APY includes compounding

- Pool Composition — which tokens it contains. Both tokens should suit you

- Protocol Age — time-tested protocols are safer

- Audits — presence of audits from reputable firms (Certik, Trail of Bits, OpenZeppelin)

- Rewards — which tokens are paid and what's their outlook

Step 3: Adding Liquidity

📋 Liquidity Addition Process (Uniswap Example)

- Connect your wallet to the protocol website (e.g., app.uniswap.org)

- Navigate to "Pool" or "Liquidity" section

- Click "+ New Position" or "Add Liquidity"

- Select tokens for the pool (e.g., ETH and USDC)

- Enter amounts — the system will show the required ratio

- Choose price range (for Uniswap V3)

- Confirm transaction — first approve tokens, then add liquidity

- Receive LP tokens or NFT position (V3) in your wallet

Step 4: Staking LP Tokens (Optional)

On many platforms, to receive additional rewards, you need to "stake" your LP tokens in a special contract (farm).

Step 5: Managing Position and Claiming Rewards

🔄 Regular Monitoring

- Track APY — it can change

- Check Impermanent Loss

- Monitor price range (for V3)

- Watch protocol security

💎 Claiming Rewards

- Click "Claim" to receive rewards

- Decide: sell, hold, or reinvest

- Consider gas when claiming frequently

- Use aggregators for auto-compounding

🚀 Profit Maximization Strategies

Professional farmers use several tactics to increase returns while controlling risks.

Strategy 1: Compounding Optimization

Concept: The more frequently you reinvest rewards, the higher your final returns due to compound interest. But each reinvestment costs gas.

📊 Optimal Compounding Frequency

| Position Size | Ethereum Mainnet | L2/Alternative Networks |

|---|---|---|

| Under $1,000 | Monthly or less | Weekly |

| $1,000 - $10,000 | Every 1-2 weeks | Every 2-3 days |

| $10,000 - $100,000 | Weekly | Daily |

| Over $100,000 | Every 2-3 days | Multiple times daily |

Strategy 2: Diversification Across Protocols and Networks

🛡️ The "Don't Put All Your Eggs in One Basket" Principle

Even the most reliable protocols can be hacked. Distribute your funds:

- Maximum 20-30% in any single protocol

- Use 2-3 different networks

- Combine strategy types (DEX + Lending + Stables)

- Keep some funds in stablecoins as reserve

Strategy 3: Timing and Pool Selection

🎯 Catch the Launch Moment

New protocols and pools often offer boosted rewards to attract liquidity. Early farmers get maximum returns.

📈 Monitor TVL

When a pool's TVL grows, your share decreases, and so does your yield. Look for pools with good APY that aren't yet overflowing with liquidity.

Strategy 4: Hedging Impermanent Loss

🛡️ Ways to Protect Against Impermanent Loss

Stablecoin Pools

Pools consisting of stablecoins (USDC/USDT/DAI) have virtually zero IL since asset prices are pegged.

Correlated Pairs

Pools of correlated assets (ETH/stETH, BTC/WBTC) minimize price divergence.

Single-Sided Liquidity

Some protocols allow depositing only one asset. IL risk remains but is managed by the protocol.

IL-Protection Protocols

Bancor and some others offer IL protection for long-term position holders.

Strategy 5: veToken and Bribes

veToken model (vote escrowed) — a mechanism where locking protocol tokens for extended periods provides boosted rewards and voting rights over emission distribution.

💰 How to Earn with veTokens

- Acquire governance tokens (CRV, BAL, VELO, etc.)

- Lock them for maximum duration (usually 4 years) to receive veTokens

- Vote for pools where you provide liquidity — this increases your rewards

- Or receive bribes — other protocols pay for votes in favor of their pools

⚠️ Risks and How to Minimize Them

Yield Farming is a high-yield but risky strategy. Understanding risks is key to long-term success.

Main Yield Farming Risks

🔴 1. Impermanent Loss

The most common risk. Occurs when the price ratio of tokens in the pool changes. The greater the change, the larger the losses.

📉 Impermanent Loss Calculator

| Price Change of One Asset | Impermanent Loss |

|---|---|

| ±25% | ~0.6% |

| ±50% | ~2.0% |

| ±75% | ~3.8% |

| ±100% (doubling) | ~5.7% |

| ±200% (tripling) | ~13.4% |

| ±400% (5x increase) | ~25.0% |

🔴 2. Smart Contract Risk

Vulnerabilities in smart contract code can lead to complete loss of funds. Even audited contracts get hacked.

✅ How to Minimize

- Choose protocols with multiple audits from different firms

- Prefer protocols with long track records (1+ year without incidents)

- Check TVL — protocols with high TVL are more battle-tested

- Follow DeFi hack news

- Don't invest more than you can afford to lose

🔴 3. Liquidation Risk (for Lending Strategies)

When using borrowed funds, a sharp drop in collateral price can lead to forced liquidation with partial loss of funds.

✅ How to Minimize

Maintain a conservative collateral ratio (Health Factor > 2.0 in Aave). Don't use maximum leverage. Set up alerts for approaching liquidation.

🔴 4. Rug Pulls and Scams

Protocol creators can withdraw all user funds. Especially relevant for new and unknown projects.

✅ How to Minimize

Research the project team. Check if creators have renounced admin functions. Avoid anonymous projects with excessively high APY.

🔴 5. Reward Token Volatility

Tokens in which rewards are paid can sharply depreciate, wiping out your profits.

✅ How to Minimize

Regularly convert rewards to stable assets. Don't accumulate large positions in speculative tokens. Consider project tokenomics.

⚠️ Additional Risks

- Stablecoin depeg risk — even "stable" coins can lose their peg

- Regulatory risks — legislative restrictions can affect protocols

- Oracle manipulation — price oracle manipulations

- Front-running — bots can "intercept" profitable trades

- Flash loan attacks — complex attacks using instant loans

🛠️ Farmer's Toolkit

Professional farmers use an entire arsenal of tools for finding opportunities, analysis, and position management.

Analytics and Opportunity Discovery

📊 DefiLlama

Main DeFi data aggregator. TVL of all protocols, yield comparison, finding new opportunities.

🔍 vfat.tools

Display of all farms with current APY. Yield calculators. Multi-network support.

🎯 APY.Vision

Detailed LP position analytics. Impermanent Loss calculation. Comparison with simple holding.

📈 Revert Finance

Uniswap V3 specialization. Position analytics, range optimization, calculators.

Portfolio Management

💼 Zapper

Unified dashboard for all DeFi positions. Simplified liquidity add/remove. Cross-chain overview.

📱 DeBank

Portfolio tracking across all networks. Social features. Whale analysis.

🔐 Gnosis Safe

Multisig wallet for large amounts. Additional security for serious farmers.

⚡ 1inch

DEX aggregator for optimal token swaps. Slippage savings.

Security

🛡️ Revoke.cash

Revoke token approvals. Regular "cleanup" protects against fund leakage.

🔍 De.Fi Scanner

Token and contract security checks. Identifying potential scams.

📋 DeFiSafety

Protocol security ratings. Detailed reviews and assessments.

🚨 Tenderly

Transaction monitoring and alerts. Transaction simulation before execution.

📋 Tax Considerations

Income from Yield Farming is taxable in most jurisdictions. It's important to keep records of all transactions.

⚠️ Important Disclaimer

Tax legislation regarding cryptocurrencies varies by country and is constantly changing. This section is for informational purposes only. Always consult with a tax professional in your jurisdiction.

💰 Typical Taxable Events in Yield Farming

- Receiving rewards — often considered income at the time of receipt

- Token swaps — may create capital gains/losses

- Liquidity withdrawal — position realization with profit/loss recognition

- Converting rewards — selling reward tokens

📝 Record-Keeping Recommendations

- Use specialized services (Koinly, CoinTracker, TokenTax)

- Record all transactions: date, amount, tokens, contract addresses

- Save screenshots and statements

- Track asset values at the time of each transaction

- Consult with a tax professional familiar with cryptocurrencies

❓ Frequently Asked Questions

💵 How Much Money Do I Need to Start?

Technically, you can start with any amount. However, on Ethereum Mainnet, due to high gas fees, it makes sense to start with $1,000-5,000. On L2 networks (Arbitrum, Optimism) and alternative blockchains (Polygon, BNB Chain), you can effectively farm with $100-500.

📈 What Are Realistic Returns?

Stable strategies (stablecoin pools, major protocols) yield 5-20% annually. Riskier strategies with new tokens can provide 50-200%+, but with high loss risk. "Thousands of percent" APY are usually unsustainable and carry extreme risks.

⏱️ How Much Time Does Management Take?

Depends on the strategy. Simple strategies through aggregators (Beefy, Yearn) require minimal attention — checking once a week is enough. Active strategies with concentrated liquidity or leverage may require daily monitoring.

🔒 How Do I Protect My Funds?

Use a hardware wallet for large amounts. Diversify across protocols and networks. Choose only audited, proven protocols. Regularly revoke unnecessary approvals. Never share your seed phrase.

🆚 Yield Farming vs Staking — Which is Better?

Staking is simpler and safer but yields lower returns (3-15% annually). Yield Farming is more complex, riskier, but potentially more profitable (10-100%+). Many combine both approaches: part of funds in staking for stability, part in farming for higher yields.

📉 What Should I Do If Token Price Drops?

Don't panic. Assess whether farming income compensates for the price drop and Impermanent Loss. If you still believe in the asset — keep the position and continue earning rewards. If not — withdraw liquidity and lock in the loss for tax purposes.

🚀 Ready to Start Earning with Yield Farming?

Start with small amounts on proven platforms. Learn the mechanics in practice before increasing positions. Remember: in DeFi, you are solely responsible for your funds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice or investment recommendations. Yield Farming involves significant risks, including complete loss of funds. Do your own research (DYOR) before making any financial decisions. Past performance does not guarantee future returns.